High Finances: Bitcoin is Not an Investment

You could be flying high on cryptocurrency, but what happens when it trends downward?

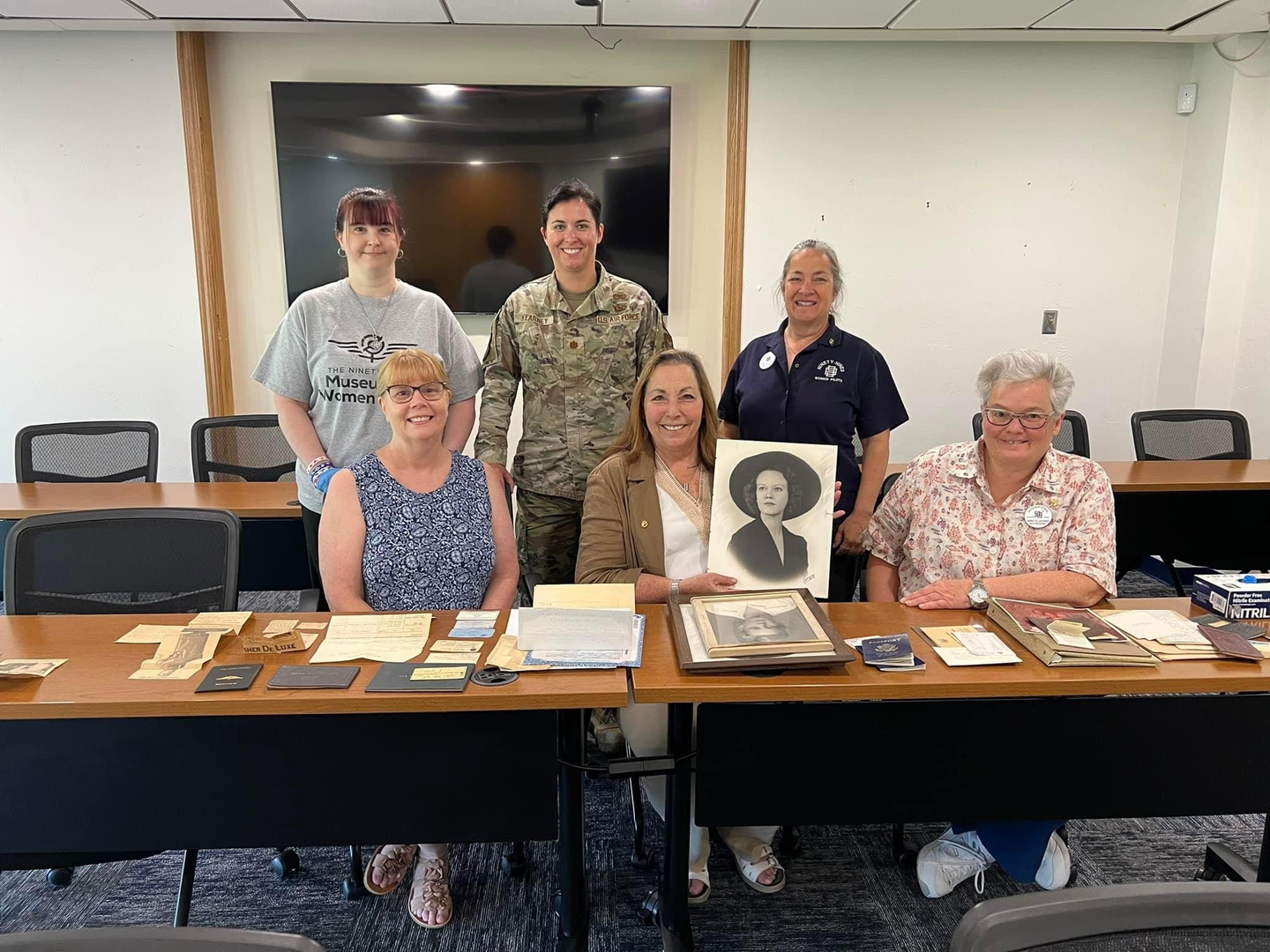

What exactly do you get when you buy cryptocurrency? [Image courtesy of Imgur]

If the headline above is true, why did I spend so long gushing about cryptocurrency last week? To understand the answer, we have to look at what an investment is in the first place.

What is an Investment?

When you buy a share of stock, you’re buying part of that company. If you buy a share of Textron (NYSE: TXT) you become a part-owner in all of their belongings. As Textron sells more aircraft, the value of the company increases. This means your share of stock is worth more. They may also pay you dividends, hard cash from their quarterly or annual profits. If you decide to sell your share of stock, you’ll hopefully be able to get more for it than you paid.

For a moment though, let’s consider what would happen if a company you invested in suddenly went bankrupt.

Most likely, another company would step in and buy the whole thing, or smaller companies would buy up the subsidiaries. Worst case, a bunch of fancy bankruptcy lawyers would sell off all of the company’s assets.

Though those components would be sold at a steep discount, the sale would generate many millions of dollars. As a shareholder, you’d be entitled to a slice of that pie. Those fancy bankruptcy lawyers would keep track of every dollar obtained through the firesales and pay out the proceeds to all of Textron’s debtors and shareholders. You would get something back on your investment.

Ideally, you’re a savvy enough investor that you would have known about your company’s woes long before it got to this point. Having noticed a decline in advertising, less of a presence at major trade shows, or news reports about financial troubles, you would have sold your shares well in advance of the company getting into serious trouble.

In either case, you’re at least somewhat protected. You have at least some ability to gauge the security of your investment. If all else fails, you’d still walk away with some money.

Cryptocurrency Valuation

Now that we know what an investment is, ask yourself: what do I get when I buy cryptocurrency?

Do you own any factories or office buildings, product inventory, or sales contracts? No! All you own when you buy crypto is a string of numbers on the blockchain. Part of that string identifies the particular coin (or fraction thereof) that you own. The other part identifies the address of your cryptocurrency wallet, the date received that money, and the wallet it came from. That’s it.

Does your cryptocurrency have value? Yes! As I type this, one Bitcoin (BTC) has a value equivalent to more than $62,000 USD!

“All you own when you buy crypto is a string of numbers on the blockchain.”

But what is that value based on?

When you buy a share of stock, its value is based on that company’s assets, including the value of its expected future sales, divided by the total number of shares of stock the company has issued. That price is backed by a lot of tangible assets.

Unlike Andy Weir’s Slugs, most cryptocurrencies aren’t backed by anything. The price of any given coin is based entirely on value perceived by people buying it. Unfortunately, for most cryptocurrencies, that valuation is skewed by a lot of baseless hype.

For a trader, there’s very little difference between Bitcoin, Ethereum, Dogecoin, or any other form of crypto. Each is just a string of numbers on a blockchain.

So why is Bitcoin worth so much more than the others?

Arguably, the biggest reason is Bitcoin was first. It’s had more time to receive attention (or generate hype) and that makes all the difference.

Bitcoin Hype-rfuel

Cryptocurrency enthusiasts celebrate Bitcoin Pizza Day as a sort of holiday. On May 22, 2010, someone spent 10,000 BTC on two pizzas. Back then, all those Bitcoins were only worth about $40. Today, they’d be worth $620,000,000!

This is a fun story to tell, and it encourages you to think you could make this kind of money buying and holding crypto (instead of spending it on pizza). This mentality has created an information-age gold rush, including all of the booms, busts, victories, and scams that you’d expect.

The Downside

It’s important to understand that very little about Bitcoin itself has changed in all this time. The Bitcoin network has grown capable of processing transactions a little more efficiently, but the currency mostly functions like it did in 2010. It’s still not backed by anything real.

The only reason the price is so high right now is that so many people are hoping that price will jump even higher and they’ll be able to offload their Bitcoins on the next chump.

More than once during its climb to such lofty heights, Bitcoin has experienced eye-watering drops too. These drops were triggered by everything from major cryptocurrency exchanges getting hacked, to government regulation changes, to new types of cryptocurrency stealing the spotlight. These drops happened literally overnight and resulted in losses as high as 80 to 90 percent.

When a stock drops in price, it’s because something goes poorly with that company. Shareholders have the ability to pay attention to what’s happening and can potentially sell in anticipation of bad news. Cryptocurrency is not so kind.

When these gigantic cryptocurrency drops happened, owners lost hundreds of millions (or even billions) of dollars of value in a matter of hours. There may have been time for some of them to minimize their losses, but for most there was no hope. Since those Bitcoins aren’t backed by any real value-holding assets, the owners who sold simply lost out.

Hello, Speculation

This is why I say cryptocurrency is not an investment. When you attempt to trade in crypto you aren’t investing, you’re speculating.

Speculation is different from investing because you don’t have a good way of predicting whether an asset’s price will go up or down, and you aren’t protected from the downside.

Is there a place for speculation in your overall investment portfolio? Maybe. I even feel that the prices of some publicly traded companies are so out of touch with reality that they’re speculative. (Hello Tesla). However, I believe most pilots would be foolish to risk their entire fortunes on speculation.

Since I know you’re probably interested in trying your hand at it anyway, next week’s column will discuss some hows and whys for pilot-level cryptocurrency speculation.

Editor’s Notes: Investing in the stock market doesn’t guarantee returns. The opinions expressed here do not constitute endorsement by FLYING.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox