Boeing Blames $3.3B Third-Quarter Loss on Supply Chain Woes

The company said the bulk of losses were a result of fixed-price defense development programs.

Boeing said the $2.8 billion in losses resulted from certain fixed-price development programs, higher manufacturing, supply chain costs, and technical challenges. [Courtesy iStock]

Boeing (NYSE: BA) lost $3.3 billion this quarter, missing earnings expectations on multiple levels, company officials acknowledged in a third-quarter earnings call Wednesday.

In the call, Boeing announced that a $2.8 billion charge in its defense unit played a big factor in its $3.3 billion quarterly loss.

On top of that, the company pointed to an embedded supply chain, and technical challenges that made it tough for it to do business efficiently this quarter.

Still, Boeing's president and CEO Dave Calhoun has maintained a face of steel as he tries to turn the multinational company around following a challenging set of years with him at the helm.

"We continue to make important strides in our turnaround and remain focused on our performance," Calhoun said.

Active Commercial Segment

In support of that statement, the CEO pointed to Boeing's $3 billion in free cash flow generated during the period, a big leap from the $507 million from the same time a year ago, and partly due to the travel rebound, wherein operators are ramping up their fleet size. For instance, Boeing said the 112 commercial airplanes it delivered in the third quarter was a 32 percent increase over the 85 it delivered during the same timeframe in 2021.

That increased Q3 revenue to $6.3 billion, including the resumption of 787 deliveries in August and higher 737 deliveries. From January to September, the manufacturer delivered 328 commercial planes, compared to 241 during the same time in 2021.

During the quarter, Boeing secured 227 aircraft orders, which includes 737s (167), 767s (27), 777s (18), and 787s (15). The company now has a 4,300 commercial aircraft backlog worth $307 billion and an overall backlog of $381 billion.

Defense Segment Pour into Loss

Despite the travel boom pushing year-over-year Q3 revenue up 4 percent to $16 billion, the company still has a ways to go to regain its pre-737-Max crash Q3 revenue.

When Boeing reported its third-quarter results in October 2018, for example, it reported revenue was $25.1 billion. Five days later, Lion Air Flight 610 crashed. The pandemic hit, and there were spill-over effects from the Russian-Ukraine war—all making regaining profitability sluggish, the company said.

"Revenue and earnings were significantly impacted by losses on our fixed-price defense development programs," Calhoun shared.

Specifically, the company said the $2.8 billion in losses resulted from certain fixed-price development programs, higher manufacturing, supply chain costs, and technical challenges.

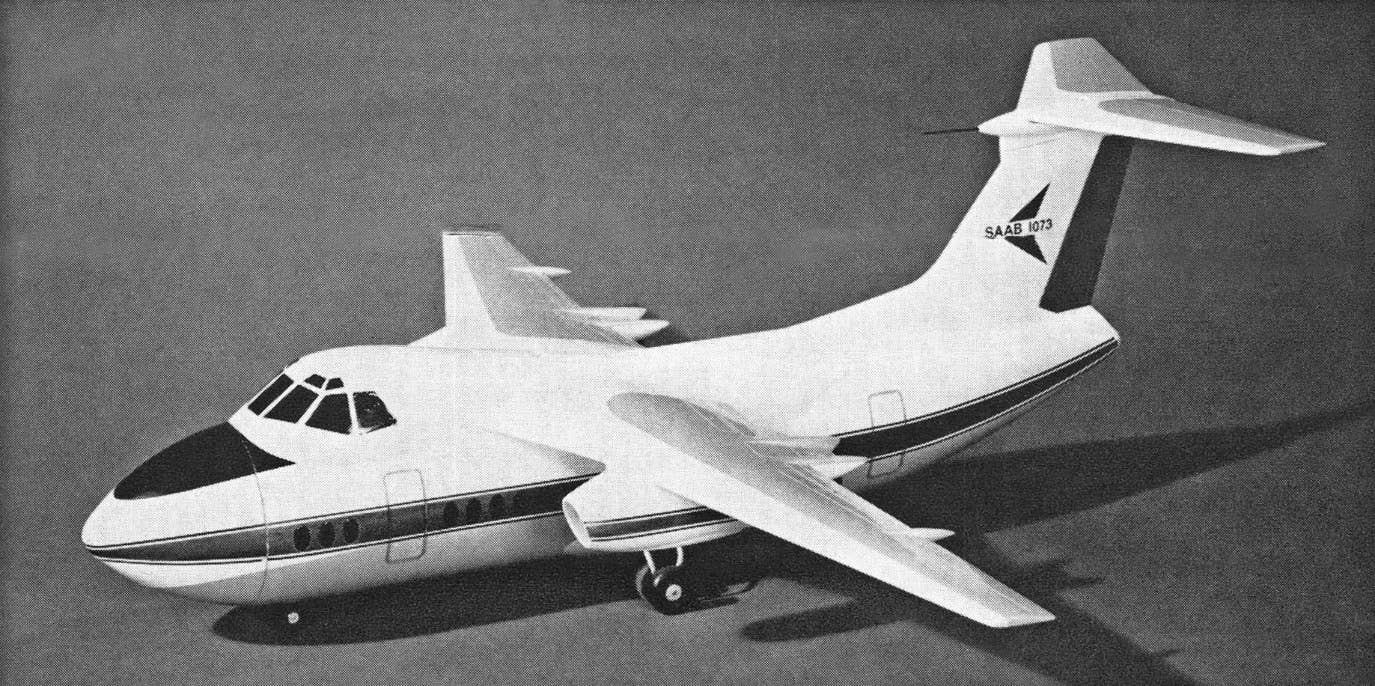

In the defense segment, Boeing said it delivered 34 aircraft and two satellites, including the first four MH-139A Grey Wolf helicopters, to the U.S. Air Force during the quarter. With that, the backlog now stands at $55 billion, with 31 percent of those orders coming from foreign customers.

International orders provided a boost. In its global services division, Boeing said revenue increased to $4.4 billion, up 5 percent over the $4.2 billion it had for the same time in 2021.

Looking ahead, Calhoun said the company would continue doing what it needs to in order to continue improving.

"We remain in a challenging environment and have more work ahead to drive stability, improve our performance, and ensure we're consistently delivering on our commitments," Calhoun said.

Following the company’s earnings call, the share price was down 8 percent, trading at $138.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox