The BMO reports on projected fleet requirements—and the flight crews needed to fly them. Thomas Hanser, Boeing

Boeing released its annual Boeing Market Outlook in concert with the Paris Air Show during the week of June 17. The report summarizes the current state of the global aviation market and projects anticipated growth 20 years into the future, broken down by region and aircraft size.

The Boeing Market Outlook punctuated an event that saw a quiet, reserved beginning for the aerospace giant (in terms of orders) evolve into a more reasonable experience. A letter of intent from International Airlines Group IAG for 200 737-8s and -10s (aka the 737 Max) helped the leader save face and move its estimated new sales total for the week to approach that of Airbus—which saw excellent response throughout the show to its debut of the A321XLR.

With the two largest aircraft manufacturers posting an estimated, combined $78 billion in new sales, the BMO's conclusion—that growth over the past decade would continue—rings true, at least for the moment. The BMO notes key factors in play, among them: "[Airline market] liberalization has encouraged significant traffic growth by removing constraints on route entry, pricing, service capacity, and airline cooperative arrangements."

A quest for greater fuel efficiency and growing environmental regulations also point to the need for new airplanes as the years progress. The industry has committed to short- and medium-term goals, which it expects will lead to reduced emissions—by 50% from 2005 levels—before 2050.

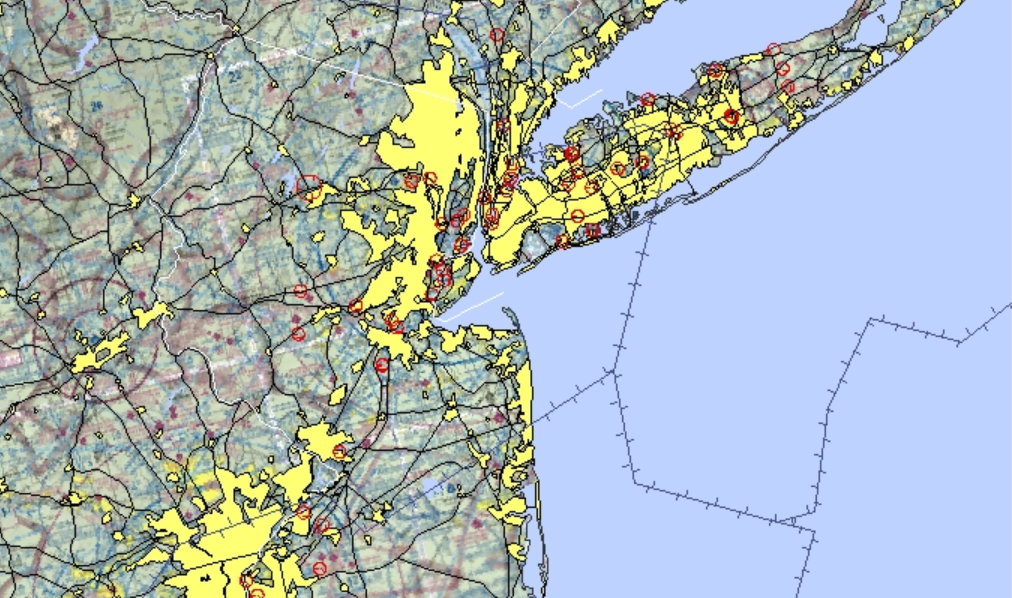

The only brake on the upward trajectory may be the inability to keep up with increased infrastructure needs. “After nine straight years of above-trend passenger growth,” reads the report, “many airports are experiencing pressure on operational capacity. This is particularly acute in high-growth regions such as Southeast Asia, China, India and in Western airports where airport expansion is artificially restricted, such as many parts of Europe.”

Low-cost carriers (LCCs) and, specifically, LCLH (low-cost long haul) operations have driven growth as well, even in mature markets such as Europe.

In its Services Outlook section, the report briefly notes the need for an additional 645,000 pilots over the next 20 years based on previous estimates. However, the company's recently released 2019 Pilot and Technician Outlook, which contains detailed predictions regarding the demand for flight and maintenance crews, increases that estimate to 804,000—along with 769,000 technicians and 914,000 new cabin crew.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox