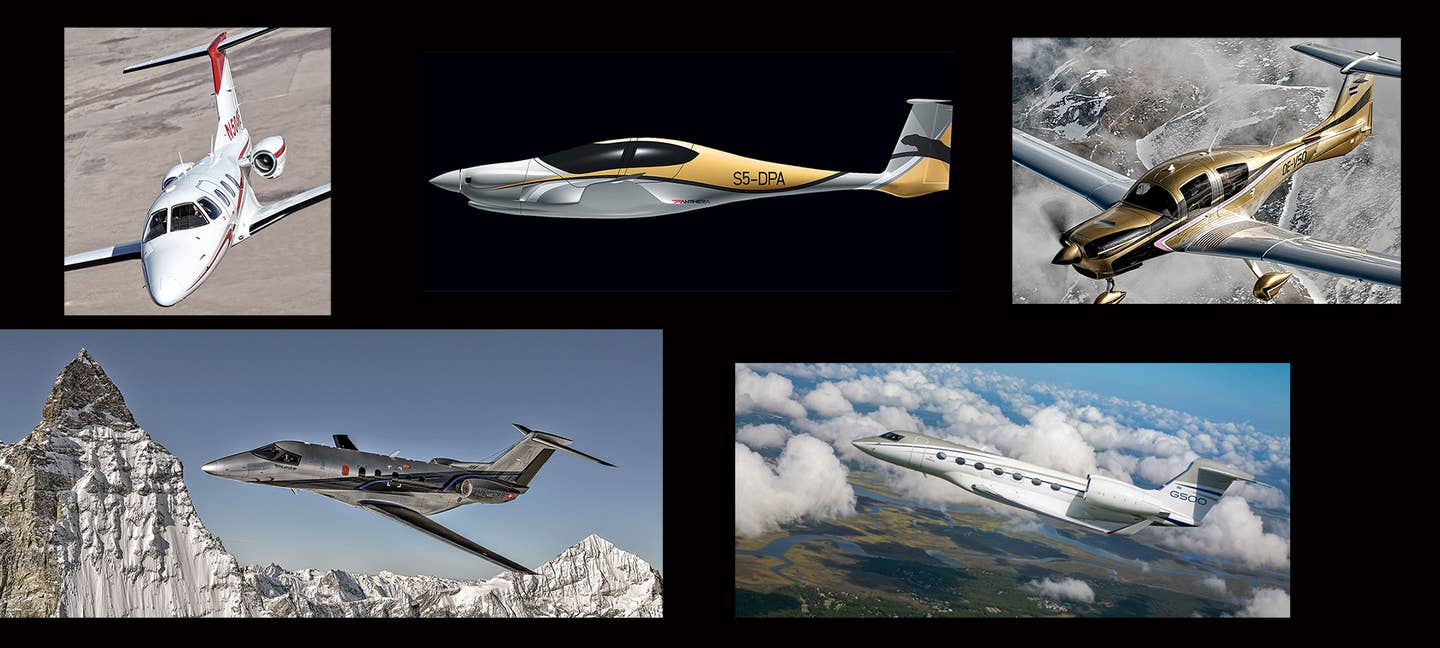

The market for new Part 23 and Part 25 general aviation airplanes has yet to see a return to the brisk sales levels recorded before the 2008 financial crisis, but slow deliveries can be blamed at least in part on the encouraging fact that many buyers say they are merely waiting for certification of new aircraft models that offer improved performance and features. A handful of manufacturers have proved this indeed is the case. For example, Honda Aircraft obtained certification for the HondaJet, which became the most delivered light jet in the world in 2017. Cirrus has increased production rates for the SR20 and SR22 with the introduction of the hot-selling Generation 6 models, and of course, buyers can’t wait to get their hands on the new SF50 Vision Jet, an airplane that is rapidly ramping up toward full-rate production in Duluth, Minnesota. Here are several in-development general aviation airplanes due to hit the market in the coming years (or, in some cases, months) that should have a big impact on the market. Pilatus PC-24

The Pilatus PC-24 gives longtime fans of the remarkable PC-12 NG turboprop single reason to cheer the arrival of its turbofan-powered counterpart, which stands out among the light-jet competition mainly because of its huge rear cargo door and the ability to alight on unimproved airstrips. Really, the PC-24 doesn’t fit neatly into any of the established business jet categories. It has the performanceof a light jet, but a cabin more on par with a midsize jet. Its ability to operate from short runways also gives it the flexibility of a turboprop. For this reason, Pilatus bills the PC-24 as the Super Versatile Jet.

It won’t be long now before people start seeing the PC-24 on airport ramps as first deliveries are poised to ramp up. In anticipation of the airplane’s market introduction, Pilatus has launched a 24/7 customer-service facility ahead of certification to guarantee the flow of spare parts and technical support worldwide, 365 days a year, an enhancement that’s also expected to benefit PC-12 customers. The number of authorized PC-24 service centers, meanwhile, is growing as maintenance technicians complete initial PC-24 training. FlightSafety International is handling all pilot and maintenance-technician training, and a full-motion PC-24 simulator is planned to be operational very soon.

With PC-24 deliveries just starting, Pilatus has invested heavily in infrastructure, increasing its footprint and installing new equipment at its headquarters in Stans, Switzerland, as well as investing $30 million in a 120,000-square-foot delivery facility in Broomfield, Colorado, which is expected to open by the middle of this year.

Gulfstream G500/G600

The Gulfstream G500 is another highly anticipated business jet that is poised to make its market debut very soon. The G500 will enter service shortly as Gulfstream delivers the last G450 model this month and begins to phase out G550 deliveries as well. The long-range G600, meanwhile, is on track to enter service a year from now.

Gulfstream announced that the G500 will be introduced with greater range than expected, allowing the aircraft to fly up to 4,400 nm at Mach 0.90, and 5,200 nm at Mach 0.85. The G500 and G600 feature a Honeywell cockpit with active sidesticks and a large number of touchscreens, as well as Pratt & Whitney Canada PW800 turbofan engines.

The G500 and G600 both feature supremely comfortable and quiet cabins, ultra long range and top cruise speeds that push up against the speed of sound. Along with the top-of-the-line G650 model, the Gulfstream family will now truly stand apart in the bizjet world as all of the new flagship models begin reaching buyers.

Bombardier Globals

Although Gulfstream has established a reputation for itself as the top purveyor of large-cabin business jets in the world, aircraft makers Bombardier, of Canada, and Dassault, of France, aren't content to let their American competitor take all the limelight. Unfortunately for both companies, however, they have faced difficulties of late, Bombardier due to a fiscal crisis related to its C Series airliner and Dassault to an unfortunate engine delay of its Falcon 5X model that ended with the cancellation of the program. Certification had already been pushed back to 2020 before Dassault was informed of new problems with the Safran Silvercrest engines.

Bombardier was forced to cancel the development of the Learjet 85 for financial reasons, but the company is moving at a brisk pace on the certification program for its flagship jets, the Global 7000 and 8000, after an earlier slowdown. The long-delayed Global 7000 is due for certification later this year. Development of the Global 8000 will resume once the 7000 is further into its flight-test regime.

Cessna Denali, Longitude and Hemisphere

Textron Aviation, the parent company of Cessna, doesn’t build large-cabin jets to compete with Gulfstream, Bombardier, Dassault or Embraer at the top echelon of the market, but the company aims to change that with the introduction of the Citation Hemisphere model. The Hemisphere is planned to be powered by the same Silvercrest engines now plaguing Dassault, but Textron Aviation is confident the issues will be remedied well before it enters flight testing next year.

And anyway, Cessna has more pressing initiatives immediately ahead, mainly to do with the flight-test program for the Citation Longitude super-midsize jet as well as development of the Denali turboprop, the first airplane to use GE’s new fadec-controlled Advanced Turboprop engine, a direct competitor to the Pratt & Whitney Canada PT6A that currently dominates the market.

The first production Longitude entered flight testing last summer, and certification and first deliveries are expected shortly. The Denali, meanwhile, which some have likened to a clone of the Pilatus PC-12 because of its general dimensions and the fact it too has a rear cargo door, is scheduled to enter service in late 2019 or early 2020.

The Denali has a flat-floor cabin that is the widest in its class. In the executive layout, it can be configured with six seats, including four facing each other in club arrangement, with a refreshment station at the front of the cabin.

Epic E1000

Another business turboprop that is turning heads is the sleek and fast Epic E1000, the first production model from Epic Aircraft in Bend, Oregon. Featuring G1000 NXi avionics in a gorgeous cockpit that leads to a modern and stylish passenger compartment, the E1000 is sure to attract buyers en masse once deliveries start later this year. The company currently holds deposits for 70-plus airplanes, but many buyers indicate they are waiting for the E1000’s certification and final performance figures to be confirmed before they write a check. If the airplane is as good as it appears on paper, there’s little question Epic will have a winner on its hands.

Following the E1000's second and final production conforming prototype flight, Epic expects to enter the market in the third quarter of 2018.

Diamond DA50

The Diamond DA50 is an interesting airplane, from an interesting company, that is part diesel single, part conventional gasoline-powered single and part single-engine turboprop, since the model will be offered with a choice of engines. Diamond Aircraft in Austria actually launched the DA50 last spring in several configurations, giving buyers a choice of four, five or seven seats; 230, 260 and 320 hp Safran SMA diesel engines; a 375 hp Lycoming engine; or a turboprop version with a Ukrainian-built turbine engine. We told you it was interesting.

Pipistrel Panthera

Alas, Pipistrel has slowed development of its sleek Panthera model as it grapples with design choices and tries to understand how relaxed Part 23 aircraft certification rules will benefit the airplane. The company is planning an all-electric version, a hybrid model and a more conventional airplane powered by a Lycoming piston engine.

The biggest change to the production version of the Panthera is a Lycoming IO-540 engine, which replaces the IO-390 used in an earlier prototype. The cabin has also been expanded to provide more head- and legroom. In all, Pipistrel has made more than 200 changes to the prototype design based on flight-test experience.

The engine change means Pipistrel will come very close to meeting its design target of producing an airplane capable of cruising at 200 knots, flying 1,000 nm legs at reduced power settings and carrying four adults with the fuel tanks full. The Panthera's normal cruise speed is projected to be 198 ktas; range at 55 percent power is 1,000 nm; and full-fuel payload tips the scales at 770 pounds. Base price is targeted at under $500,000.

Flight Design C4

The Flight Design C4 is another model that has been set for "relaunch" now that the Part 23 rewrite has gone into effect and a new owner has taken control of the company. Lift Holding, the new owner, is "seeking partners" to help finance and manufacture the four-seat design, with a hope to achieve certification next year.

Production of the Flight Design CTLS and CTSL has continued at a low level at Flight Design’s manufacturing and engineering base in Kherson, Ukraine, but it’s unknown what progress has been made on the C4. When it was first announced, the airplane was set to sell for around $250,000 with the performance and room of light general aviation airplanes selling for almost twice as much.

Eclipse 700

Another project with an uncertain future is the Eclipse 700, a larger and more capable version of the Eclipse 500 and 550 models originally developed by Vern Raburn’s abortive company but now out of production as the parent company, One Aviation, faces financial difficulties. Much of the trouble appears related to One Aviation’s other manufacturing arm, Kestrel, a single-engine-turboprop project being led by Cirrus co-founder Alan Klapmeier.

One Aviation laid off most of its production workers last fall as it phased out production of the Eclipse 550 very light jet to transition to the Eclipse 700. The Albuquerque, New Mexico-based company says it continues to work to raise funding for the larger Eclipse 700, known as Project Canada, an airplane that was expected to be the first jet certified under the new Part 23 rules. The timetable for the Eclipse 700’s development is less certain now.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox