General Electric Announces Split Into Three Public Companies

General Electric announced Tuesday that it will split into three publicly traded companies, delineating its aviation, healthcare, and energy segments for a special focus on growth beginning in 2023.

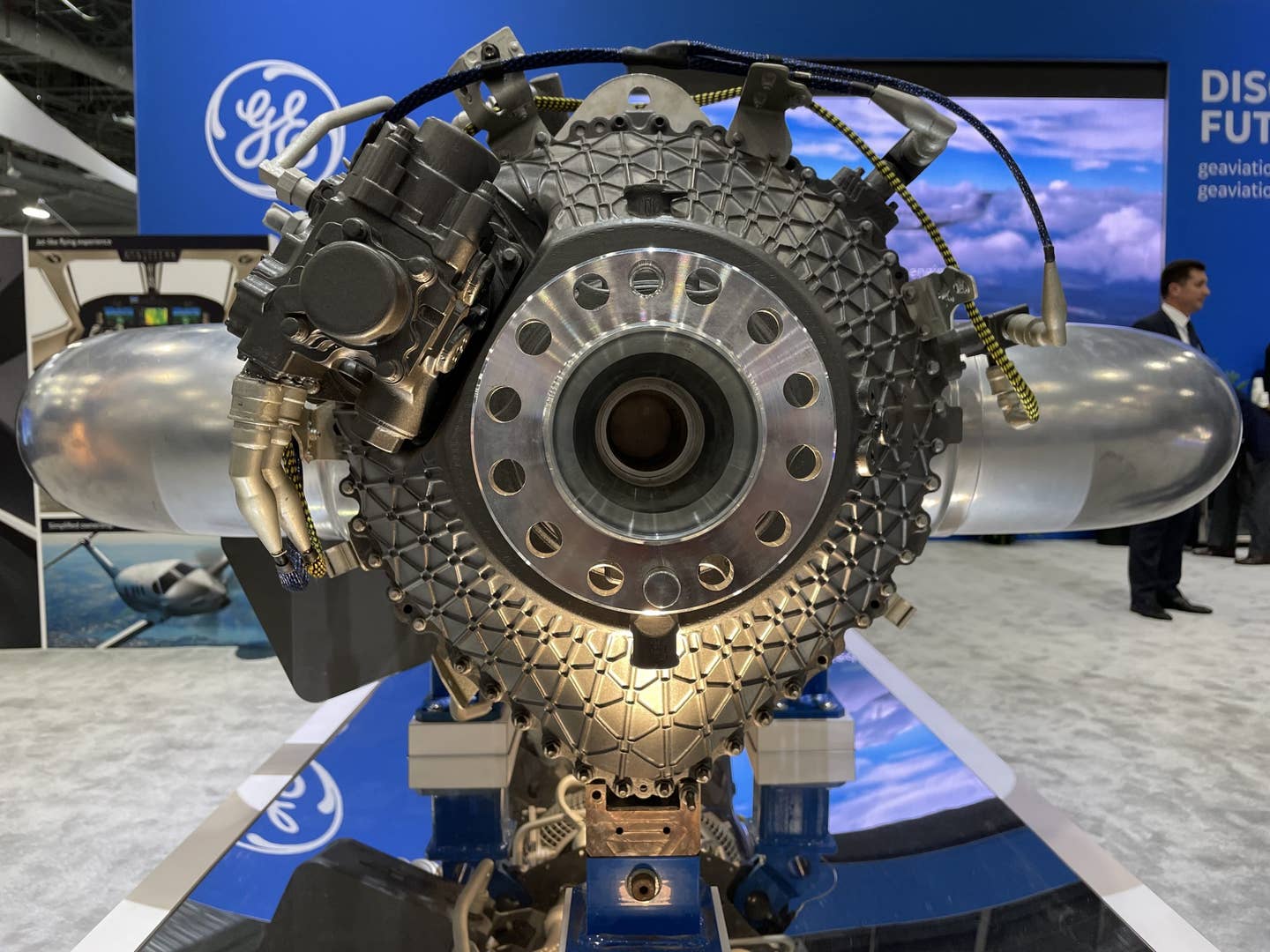

The GE Aviation Catalyst engine is part of the company’s ongoing strategy to focus on the aviation market. Julie Boatman

General Electric announced Tuesday that it will split into three publicly traded companies, delineating its aviation, healthcare, and energy segments for a special focus on growth beginning in 2023.

The goal: “Following these transactions, GE will be an aviation-focused company shaping the future of flight,” the company said in a statement.

In a statement to FLYING, a GE spokesperson elaborated further. “While it’s early in the process, we are optimistic about GE Aviation, which will form the core of the aviation-focused GE of the future.” The spokesperson also noted there would be “no anticipated impact to facilities or employees at this time.”

The giant manufacturing and technology corporation will combine its GE Digital, GE Renewable Energy, and GE Power business units into one company, with GE Aviation and GE Healthcare forming the other two entities.

We are excited to announce that GE is forming three industry-leading, global public companies focused on the growth sectors of aviation, healthcare, and energy. https://t.co/DIFs2jU7O9 pic.twitter.com/O8DwrIOmF1

— General Electric (@generalelectric) November 9, 2021

Further, GE intends to “execute tax-free spin-offs” of GE Healthcare in early 2023, and the renewable power and energy unit in early 2024, according to the announcement. GE anticipates it will retain a 19.9 percent stake in GE Healthcare.

The move is made by GE to achieve the following:

- Gain a deeper operational focus, accountability, and agility to meet customer needs

- Tailor its capital allocation decisions to fall in line with distinct strategies and industry-specific dynamics

- Flex in a strategic way to pursue growth opportunities

- Create distinct and dedicated boards of directors with deep expertise in each domain

- Leverage business- and industry-oriented career opportunities internally, with incentives for employees

- Construct more compelling investment profiles appealing to broader, deeper investor bases

“At GE we have always taken immense pride in our purpose of building a world that works,” H. Lawrence Culp, Jr., GE’s chairman and CEO, said. “The world demands—and deserves—we bring our best to solve the biggest challenges in flight, healthcare, and energy.

“By creating three industry-leading, global public companies, each can benefit from greater focus, tailored capital allocation, and strategic flexibility to drive long-term growth and value for customers, investors, and employees.

“We are putting our technology expertise, leadership, and global reach to work to better serve our customers.”

John Slattery will remain CEO of GE Aviation. Slattery posted on LinkedIn reflecting on his optimism ahead of the changed landscape.

According to the Wall Street Journal, the company’s stock price was up 8.8 percent in premarket trading, and settled at 111.29, a rise of 2.65 percent on the day.

Via a market report on Seeking Alpha: “The company expects to incur [roughly] $2 billion in onek-time separation, transition and operational costs, and less than $500 million in tax costs.”

GE Aviation’s Catalyst engine marches towards certification to serve the turboprop market, while the business unit was also recently selected to join forces with Kaman Aerospace Group in developing a high-speed, tilt-wing VTOL for Transcend Air.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox