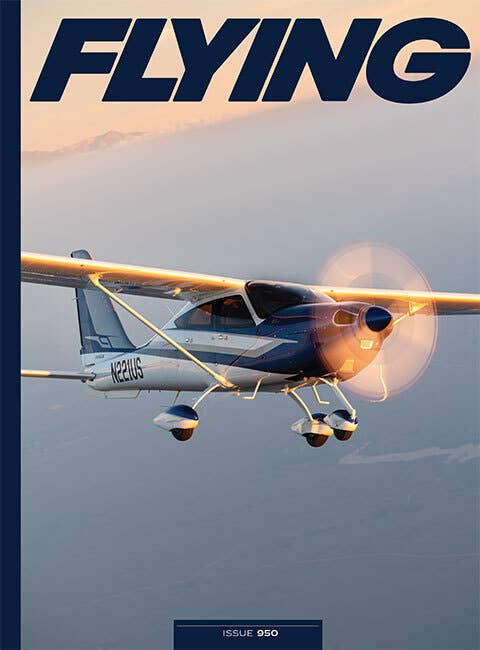

On a trip from Tampa, Florida, to New Orleans, FLYING contributor Dick Karl had a bird strike–a big one. [Courtesy: Dick Karl]

Have to have it, but can you afford it?

There were several months last winter when I cared nothing about airplanes. Bedridden for a month by the one-two punch of a bone marrow transplant for acute myeloid leukemia, I was so sick that I didn’t think about my lifelong love—aviation.

If you're not already a subscriber, what are you waiting for? Subscribe today to get the issue as soon as it is released in either Print or Digital formats.

Subscribe NowAs I have picked myself up off the canvas, I find my old interests rekindled.

Thoughts have now turned to getting an airplane. These fantasies are tempered by the realization that I’m still not out of the woods, and I’m not getting any younger. Nonetheless, you’ll find me physically at the airport and my nose in Controller. It is time to think about getting another airplane.

For somebody approaching 80, there are several hurdles to aircraft ownership. What is affordable? What is insurable? Is hangar space available? Can I fly with BasicMed? Is the right airplane out there? Do I have the cognitive and physical skills to fly? After all, it’s been a tough year.

The insurance picture for most of my flying career has been pretty predictable. For over 50-plus years of aircraft ownership, I’ve found reasonable coverage at a reasonable price. That is, until two years ago.

For the great majority of that time, I’ve had a happy relationship with one broker. When I first used Wenk Aviation Insurance, I dealt with the patriarch. Subsequently, I have dealt with his daughter and now her son. Every spring I’d fill out a pilot form detailing my hours, ratings, training experiences, and incidents, if any.

A few weeks before renewal was due, I’d get a quote, instruct the broker to bind me, and go to the airport. For years this predictable cadence played out without surprise or mystery. During the 17 years my wife, Cathy, and I owned a Piper Cheyenne turboprop, the annual cost was remarkably stable. In 2001, I paid $8,900. Ten years later in 2011, I paid $9,978 which made sense based on the replacement value of the aircraft. Then in 2018, we bought a Beechcraft Premier for twice what we paid for the Cheyenne and yet our annual rate was only $11,537 for single-pilot operations.

But eight months later, we learned why you have insurance. On a trip from Tampa, Florida, to New Orleans, I had a bird strike–a big one. Just leaving 4,300 feet, a pelican struck the inboard leading edge of the right wing. Weighing up to 15 pounds, the bird impacted the airplane at 250 knots—a lot of kinetic energy. After we returned to base, the dent in the leading edge was obvious—a bent wing spar.

- READ MORE: That Sound of Music in the Air

Try as Textron might, the Beechcraft Premier was not well supported. No repair or replacement could be found, and the airplane was deemed a write-off, the engines were pickled, and the avionics removed. The salvage value of these high dollar components would soften the blow for the insurance company.

At the settlement, I received a check for the insured amount, and it was the biggest check I’d ever seen. It caused quite a stir when I went to a small bank branch office to deposit it. I got in the single cashier line and followed a gentleman who had written himself a check for $40. “I’d like that in 20s,” he told the cashier.

For fun I said the same thing as I slid my seven-figure check under the glass.

We took that money and bought a Cessna CJ1. Insurance jumped to $22,250. Though the bird strike wasn’t a result of negligence or poor piloting, the fact was I had made a claim. The new price seemed reasonable to me, given the circumstances.

Modest increases came annually as expected until four years later when the real shock came–my total annual premium was estimated to be $92,888. My transgression? I had turned 77 years old. No way could we afford to keep the jet and fly it single pilot at that point.

There’s been a lot written about the aviation insurance market and the age discrimination that I experienced. Despite my high time and Part 135 real-world experience, I was deemed to be too big a risk for reasonably priced insurance. I sought to find data that would warrant such a penalty for age but really couldn’t find any. I even offered to do recurrent simulator training every three months but the insurance company wasn’t interested.

Given the way brokers work in this market, I was pretty certain that mine had shopped my information to all potential insurance carriers. Changing brokers wouldn’t likely make a difference, though I thought about it. I took my grievances to that year’s Citation Jet Pilots annual meeting. An acquaintance told me he thought his broker could do better.

I went to that broker’s booth at the CJP convention and came away encouraged. I’d be hearing soon. Then…crickets. The broker ghosted me. He wasn’t at his office when I called. Nobody was sure when he’d be back. A message would be left, but I never heard from him. I was out of the jet.

On October 30, 2022, I flew single pilot from Austin, Texas, to Tampa. The following day I was not insured to fly the airplane by myself.

Now I’m thinking of a Cirrus SR22 or Cessna 340. The Cirrus is popular—and expensive. A 10-year-old model can cost $500,000. Most have awesome avionics and it cruises at 170 knots, so long distances are leisurely affairs. The airplane requires one to climb on the wing in order to board which doesn’t get easier as you age.

The best news is that the estimated insurance cost for me is around $35,000.

The venerable Cessna 340 would be a throwback thrill for me—it was my first twin 30 years ago. Surprisingly, parts seem not to be a problem since there were many built in the 1970s and ’80s. Most have had glass avionics added and sell for about the same as the Cirrus. For this you get at least 190 knots, higher cruising altitudes, and cabin-class seating with the ease of airstairs for boarding. There is no parachute, though.

Insurance estimate is about $42,000.

If my next health checkup is encouraging, look for me at your airport looking at one of these airplanes. Be sure to say hello.

This column first appeared in the October Issue 951 of the FLYING print edition.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox