Drone Insurance: What You Need and Where to Get It

Here’s help understanding the different types of drone insurance to help protect your investment.

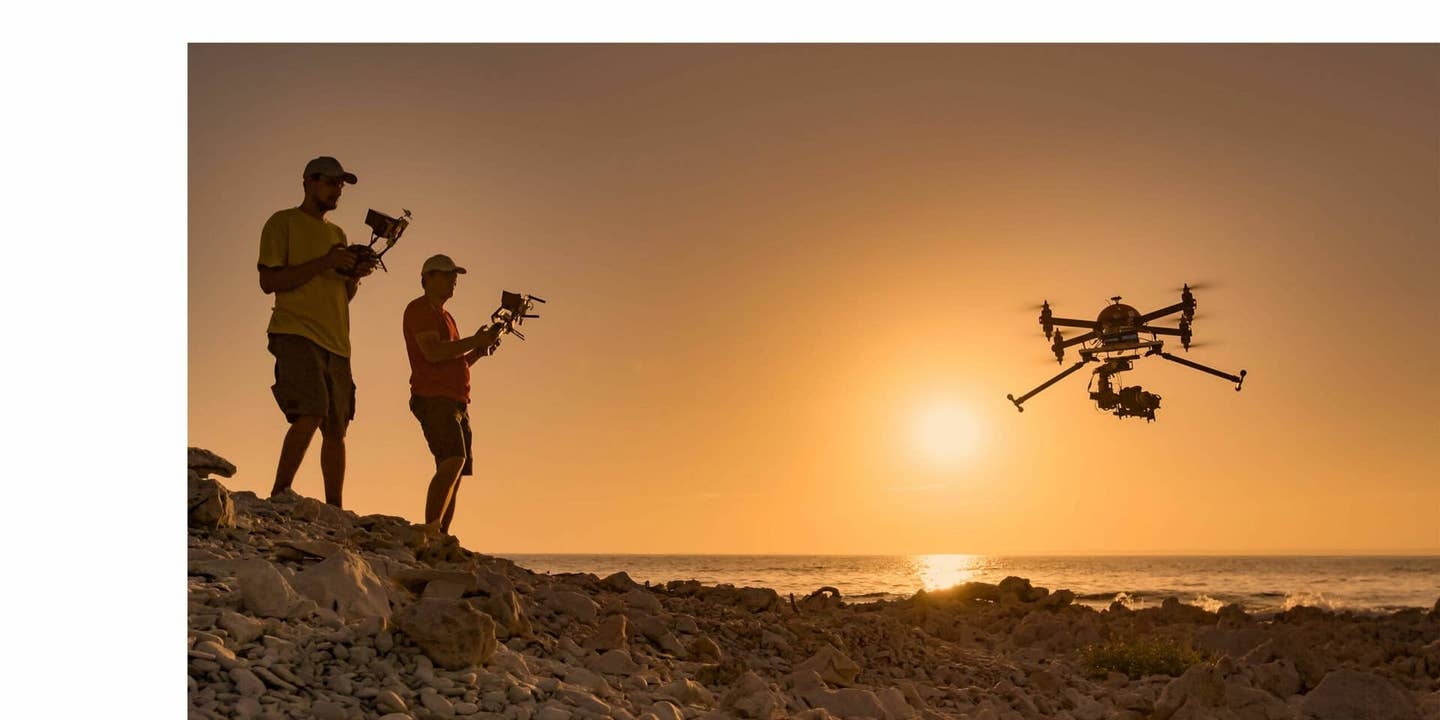

Drone insurance gives both recreational and commercial users peace of mind, knowing that they are protected in the event of an accident or legal dispute. [Credit: golubovy]

If you fly drones, whether as a hobby or professionally, you have probably heard people talking about drone insurance. Insurance is one of those things we all complain about paying for until we actually need it.

Accidents can happen, and given the potential for property damage or liability issues, drone insurance provides financial protection for both individuals and companies.

As the drone industry continues to grow, hundreds of thousands of drones are already taking to the air. As drone numbers increase, the skies will get more congested, and the likelihood of accidents will increase.

Even if you live in a rural area, malfunctions or bird attacks can occur, downing your drone even without any pilot error.

While it is always a good idea to talk to a licensed insurance agent before purchasing any policy, we’ll provide you with an understanding of what exactly drone insurance is so you can enter that discussion with some knowledge on the topic.

Understanding Drone Insurance

Drone insurance is designed to cover the risks associated with operating uncrewed aerial vehicles (UAVs), especially for a commercial drone pilot.

Just like car insurance, drone insurance provides coverage for property damage, liability, and, in some cases, damage to the drone itself (hull coverage). Understanding the types of UAS insurance available can help you make an informed decision about the type and level of coverage you need.

Insurance comes in all shapes and sizes, but for drone pilots, there are three main types you should know about:

- Property damage coverage

- Liability insurance

- Hull coverage

Property damage coverage: This protects you if your drone causes damage to someone else’s property. For example, if your drone crashes into a car or building, property damage coverage will help pay for the repairs.

Liability insurance: This covers you if your drone causes injury to someone or if you face legal action due to an accident involving your drone. This is particularly important for commercial drone operators, as injuries or lawsuits can result in substantial financial losses.

Hull coverage: It covers the cost of repairing or replacing your drone if it is damaged in an accident. This type of coverage is particularly useful for expensive drones, where the cost of replacement is high.

Several factors can affect UAV insurance premiums, including the type of drone you’re using, your level of experience as a pilot, and how you intend to use the drone. Commercial drone pilots may pay more for insurance than recreational users due to the increased risks associated with business activities.

Why Drone Insurance Is Important

No one likes spending money when it seems like they are getting nothing in return. Drone insurance can feel like that, but there are several reasons why it is important.

First, many customers looking to hire commercial drone pilots will only look for pilots with insurance. Second, even if you have never had an accident, you can still lose a drone. I lost one due to a technical malfunction and saved several thousand dollars thanks to my drone insurance.

Here are some additional reasons why drone insurance costs are acceptable:

Legal requirements: Some jurisdictions may require commercial drone pilots to carry liability insurance. It is rare, but it can happen. In the United States, the FAA requires commercial drone pilots to have a Part 107 license but does not require you to have drone insurance.

Financial protection: Drones can be expensive, and repairing or replacing them after an accident can cost thousands of dollars. Drone insurance helps cover these costs, protecting you from unexpected financial burdens. Also, if your drone causes property damage or injury, the resulting legal fees and settlements can be substantial. Insurance can save you from these potentially ruinous expenses.

Peace of mind: Operating a drone without insurance can be stressful, especially if you’re flying in high-risk areas such as urban environments or near crowds. Insurance gives both recreational and commercial users peace of mind, knowing that they are protected in the event of an accident or legal dispute.

Choosing the Right Drone Insurance Policy

When selecting a drone insurance policy, there are several factors to consider. Specific needs and types of coverage will vary from one pilot to another.

Here are some of the main considerations that will affect everyone:

Coverage limits: Look for policies that offer adequate coverage for property damage and liability. The amount of coverage you need depends on the value of your drone and the potential risks associated with your flying activities. For example, if you’re flying drones in busy urban areas, you’ll likely need higher liability coverage than if you’re flying in remote locations. A good industry minimum is $1 million of liability coverage.

Deductibles: Consider the deductibles associated with your policy. Higher deductibles can lower your insurance premiums but may require you to pay more out of pocket if you need to file a claim.

Exclusions: Be sure to review any exclusions in the policy. Some insurance policies may not cover specific types of accidents, such as those caused by pilot error or flying in restricted areas.

Comparing providers: There are several drone insurance providers on the market, and it’s worth comparing their offerings to find the best fit for your needs. Be sure to compare factors such as coverage limits, premiums, and customer reviews to determine the best value.

Drone Insurance Claim Process

Every drone insurance company has a slightly different process, but I’ll walk you through how SkyWatch Aviation Insurance handles its claim process since this is the insurance company I use and have filed claims with before.

Before getting into that, there are three points that need to be covered.

First, if you are doing commercial work, you need to have a Part 107 license.

I doubt any insurer will pay you if you are working and unlicensed. If you need a license, check out online courses such as those offered by Altitude University and the Pilot Institute or use study materials such as those on Sporty’s Pilot Shop website.

Second, remember your drone probably has a flight log that records what it is doing.

In the event you need to file a claim, the insurer will definitely ask to be sent the drone’s flight log. So, don’t think you can fly the drone in conditions where it isn’t meant to fly, crash it, and say there was a mechanical error. The insurer will look at the log. More to the point, saying something happened that didn’t would be insurance fraud.

Third, make sure you are paying your insurance bill. If you skip a payment, the insurer will not pay a claim. It seems like common sense, but it is worth mentioning.

Let’s review the process with a real example from one of my flights.

I was filming vacant land in California’s Mojave Desert a few years ago for a real estate client. During the last flight of the day, my drone suddenly turned away from me and took off in the opposite direction, deep into the desert. The controls wouldn’t respond, and when the drone’s battery finally died, it was in a location too dangerous to try and retrieve.

I wrote down what happened in my flight log, took a screenshot of the remote with the drone’s last location, and began the process of filing a claim.

For SkyWatch, you log in to your online account and fill out the claim form. The form basically has you provide all the information about the event and the loss.

Shortly after the form was submitted, I received a call from one of the representatives at SkyWatch. They had me recount the event (I assume to make sure my story matched the form), had a few additional questions, and requested my flight log.

After providing everything, I waited about two days, and I received an electronic deposit for the replacement cost of the drone minus my deductible. Within about a three-day period, I had gone from losing one of my drones to having the replacement in hand. It’s that simple.

Final Thoughts on Drone Insurance

My recommendation is to have at least $1 million in liability insurance and hull coverage on the drones you plan on flying.

For SkyWatch, I have liability coverage and hull coverage on two drones I use most of the time, and I pay around $70 per month. Make sure to keep records of your insurance paperwork on hand when you are flying. You never know when you might need them, so have them ready at a moment’s notice.

Drone insurance is an essential safeguard for both commercial and recreational operators. It provides legal compliance, financial protection, and peace of mind, ensuring that you’re covered in the event of an accident or safety incident.

By understanding the different types of drone insurance, choosing the right policy, and making sure you are ready to file a claim if needed, you can operate your drone with confidence and protect your investment.

While drone insurance is important, it is equally important to maintain drone flight safety. Make sure to refresh yourself on the essential gear and tips for flying safely.

FAQ

Is it worth getting drone insurance?

It depends on your level of comfort with regard to risk. Personally, I think every drone pilot should have insurance. It gives you peace of mind, and many clients will want you to have liability insurance.

Does the FAA require drone insurance?

No. There is no legal requirement to have drone insurance.

Do I need insurance for a drone?

Most people will tell you to at least have liability insurance. Hull insurance is optional, but many providers offer it for a few dollars a month. In most cases, it is worth it. The first time you lose a drone and can replace it by only paying a deductible, you’ll be glad you had it.

What is the average cost of drone insurance?

The cost varies between providers and what types of coverage you want. You can get good drone insurance for $50 to $100 a month.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox