Jets: Reaching the Service Ceiling

The jet market softened after a period of COVID-induced thrust.

Demand for Cirrus’ single-engine SF50 Vision Jet remains strong. [Courtesy: Cirrus Aircraft]

The business jet market, paralleling the flight path of the general economy, is leveling off after two years of post-COVID soaring. The flattening is more pause than plateau, says Rolland Vincent, head of the market research and consultant company bearing his name in Plano, Texas.

“Nothing surprises me,” says Vincent. “We were on a sugar high in 2021 and 2022, fed by essentially free money. Now with middle single-digit loan rates, we’re getting back to a more normal market.”

Adds Ron Epstein, senior equity analyst at Bank of America: “The COVID recovery was kind of a weird thing. We’re getting back to a normal [growth] trajectory pre-COVID.”

Rising interest rates haven’t yet been much of a damper on new aircraft sales, as up to 60 percent to 70 percent of purchases now are all cash or 50 percent cash down/50 percent financing. Less than one-third involve a large loan. Some buyers look at 6 percent aircraft loan rates in relation to the 8 percent returns they’re making on investments, so they’re choosing to finance aircraft purchases rather than tying up cash.

The current market cooldown is more related to supply chain snags, particularly as noted by the heads of Bombardier, Dassault, and Gulfstream. Éric Martel, Bombardier’s CEO, says fewer of the firm’s suppliers have problems, but the remaining ones have systemic issues that need remedial work. Bombardier has its own specialists embedded with key suppliers to provide support should issues arise.

Dassault chief Éric Trappier points out that supply chain issues in 2023 are worse than last year, partly from the fallout of Russia’s invasion of Ukraine. Some materials, such as titanium, are in short supply, and European aerospace manufacturer’s energy costs have soared. In mid-July, Trappier disclosed that sales had slowed in the first half of 2023 as compared to the same period in 2022 in large part because of the war in Ukraine.

Gulfstream president Mark Burns says that while supply chains are constricted, the Savannah, Georgia, firm began reordering parts and materials two years ago, resulting in fewer challenges. Phebe Novakovic, CEO and chairman of General Dynamics, Gulfstream’s parent company, has modestly scaled back projected deliveries for 2023.

There’s an upside to supply chain snags, says Epstein, because “it prevents anybody from spoiling the party because it forces production discipline.” Simply put, manufacturers cannot flood the market with an oversupply of airplanes.

Market growth also is being constricted by aircraft certification delays. Similar to many other organizations, the FAA encouraged many employees to work remotely during the COVID-19 pandemic. Several staff members have been reluctant to move back to FAA offices after experiencing the freedom and flexibility of their remote workplaces. Industry observers claim sparsely staffed FAA certification offices are creating long delays in paperwork processing.

In addition, the FAA has doubled down on its aircraft certification checks in the wake of the Boeing 737 Max debacle, delaying by several months the type certification of the Dassault Falcon 6X and Gulfstream G700 and G800, plus potentially the Beechcraft Denali in 2025.

Prospects for smaller turbofan aircraft already in production remain bright. Cirrus, for instance, delivered 90 single-engine SF50 Vision Jets in 2022, according to the General Aviation Manufacturers Association (GAMA) aircraft shipment report. Demand for the entry-level Vision Jet remains strong because it’s an easy step up from Cirrus’ piston singles, owing to its combination of docile handling, human-centered flight deck design, passenger amenities, and top-notch customer support. It’s very similar to the success that Cessna enjoyed 50 years ago when it introduced the mild-performing, twin-turbofan Citation 500 as a modest step-up product from its 300- and 400-series piston twins.

The Vision Jet is the only turbofan aircraft as of yet to offer both a standard airframe parachute system and Garmin Autoland—branded Safe Return—providing unsurpassed peace of mind to occupants. Similar to the long-term growth plan that Cessna had with its Citation500 family, Cirrus is expected to develop faster, higher, and farther-flying turbofan aircraft as follow-on products to the Vision Jet. As FLYING previously reported, Cirrus Aircraft filed for a $300 million initial public offering on the Hong Kong Stock Exchange to provide funds for new aircraft development and increased pro-duction capacity, among other growth goals.

- READ MORE: We Fly: Cirrus Vision Jet G2+

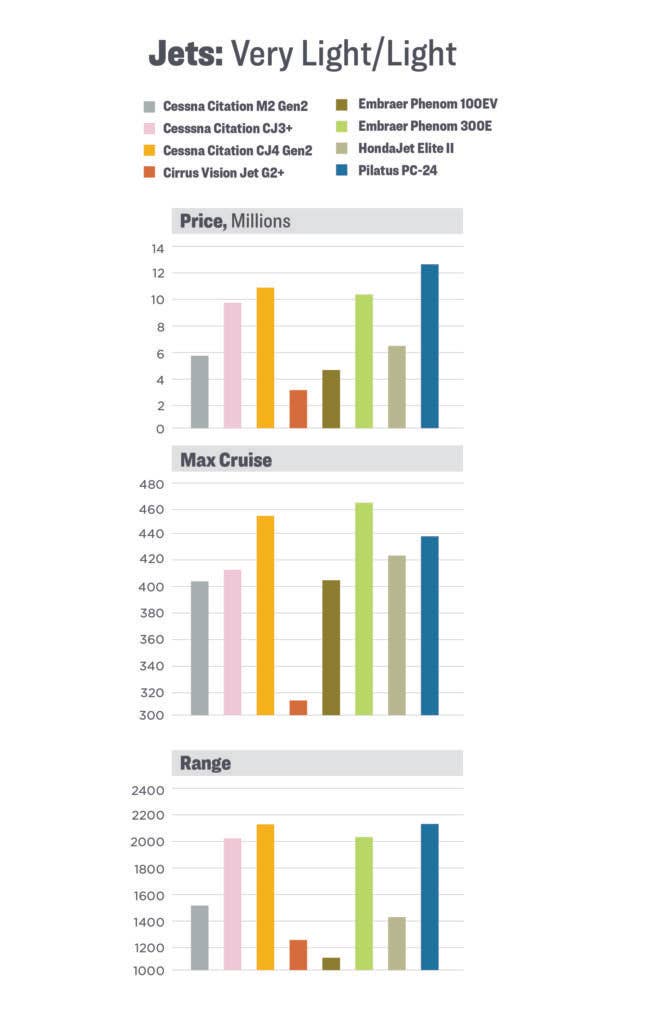

Deliveries in the light jet twin-turbofan market continue slowly to decline, in large part because of the steep drop in demand for Embraer Phenom 100-series aircraft, once the most popular light jet by a wide margin.

Phenom 100 deliveries soared during its first two full production years (2009-2010) for the 100, with Embraer producing nearly 200 units. The Phenom 100 completely eclipsed its archrival, the Cessna Citation CJ1+, a light jet that was $1 million more expensive and somewhat slower. The Phenom 100’s introductory price was on par with the Cessna CE-510 Mustang, but its cabin cross section was nearly as big as the Learjet 45. The Phenom 100’s tall stance and airstair door made it look even larger than its actual size, adding to its perceived value. Owner pilots also favored the Phenom 100’s Garmin G1000 avionics package over the CJ1+’s Collins Pro Line 21 system.

Three years later, Textron Aviation responded by delivering Citation M2, a CJ1 variant with more thrust, Garmin G3000 avionics, a plusher interior than the Embraer, a 40-plus-knot cruise speed advantage, 160 nm more range, and a more attractive price tag than CJ1+. Within a few years, M2 took the sales lead from Embraer in this class and it clearly has maintained it. M2 steadily is catching the Phenom 100 in total sales, with Textron now having delivered more than 340 Citation M2 jets compared to Embraer’s 400-plus Phenom 100 aircraft.

M2 deliveries also surpass those of HA-420 HondaJet, despite the latter’s having a roomier cabin, higher cruise speeds and, arguably, the quietest interior in the light jet class. The Citation, however, offers superior runway performance and a roughly $800,000 lower price.

Veteran buyers also are keen on product support, giving Textron Aviation a major competitive edge over Embraer and Honda Aircraft, according to some industry observers. Textron Aviation delivered nearly double the number of M2 jets in 2022 compared to the HondaJet, and it’s on track to preserve a similar margin in 2023. Phenom 100 comes in a distant third.

Competition in the upper end of the light jet market is far different. Three competitors, Embraer’s Phenom 300E and Textron Aviation’s Citation CJ3+ and CJ4 Gen2 face off. The Brazilian offering has compelling advantages—biggest cabin volume, lowest cabin altitude, longest range, highest cruise speed, and smallest price. Phenom 300/300E deliveries, as a result, now exceed those of CJ3+ and CJ4 Gen2 combined. The Phenom 300 also siphoned off so many Learjet 75 orders that Bombardier was compelled to shut down production. Notably, the Phenom 300 has been the best-selling light jet for more than a decade. And it’s the only light jet to be purchased by all three major fractional aircraft operators—NetJets, Flexjet, and Airshare.

The upmarket Pilatus PC-24 resides in a class of its own, straddling the boundary between light jets and midsize aircraft. Its 18,300-pound max takeoff weight, fuel efficiency, single-pilot certification, and runway performance make it competitive. Its 500-cubic-foot cabin volume, flat floor, standard autothrottles, and 400-knot block speed nudge it into the midsize niche. The right engine has a special low idle rpm ground mode that enables it to double as an APU, thereby providing heating, air conditioning, and electrical power when the aircraft is parked. The PC-24 is the only jet in either class to have a 4.2-foot high by 4.1-foot wide aft cargo door. It can use unpaved runways, just like the PC-12 NGX turboprop. That increases the number of landing facilities it can use from 10,650 to 21,000.

Textron Aviation’s Citation Ascend, the fifth-generation Citation CE-560XL, is the last remaining truly midsize class jet. Gone are Citation III/VI/VII, Hawker800, Gulfstream G150, and Learjet 60. None had the 560XL’s blend of short-field performance, cabin comfort, operating economics, and low purchase price—though it won’t reach the market until 2025.

Ascend could be the last member of the venerable CE-560XL family, a placeholder to buy time for Textron Aviation to develop a clean-sheet replacement aircraft with more speed, more range, and more cabin volume. At nearly $17 million, Ascend’s price point puts it close to the $18 million Embraer Praetor 500, a super-mid-size aircraft with 70 percent more range, 40 to 70 knots more speed, and half again more cabin volume.

- READ MORE: Citation Ascend Mock-Up to Debut at NBAA

The Praetor 500 can fly nonstop between almost any two U.S. continental coastal cities at Mach 0.80 against winter winds. It has the lowest cabin altitude in its class, 5,800 inside while cruising at 45,000 feet. It boasts full-tanks, full-seats loading flexibility. It has a wet galley, vacuum lavatory, and optional Viasat KA-band SatCom connectivity. It’s the least expensive jet in FLYING’s Buyers Guide to boast fly-by-wire flight controls, a technology that used to be available only on the most expensive jets from Bombardier, Dassault, and Gulfstream. Topping all that, it beats Citation Ascend’s short-field performance on equal length missions. However, being much heavier than Citation Ascend, Praetor 500 burns 20 to 25 percent more fuel.

- READ MORE: We Fly: Embraer Praetor 500

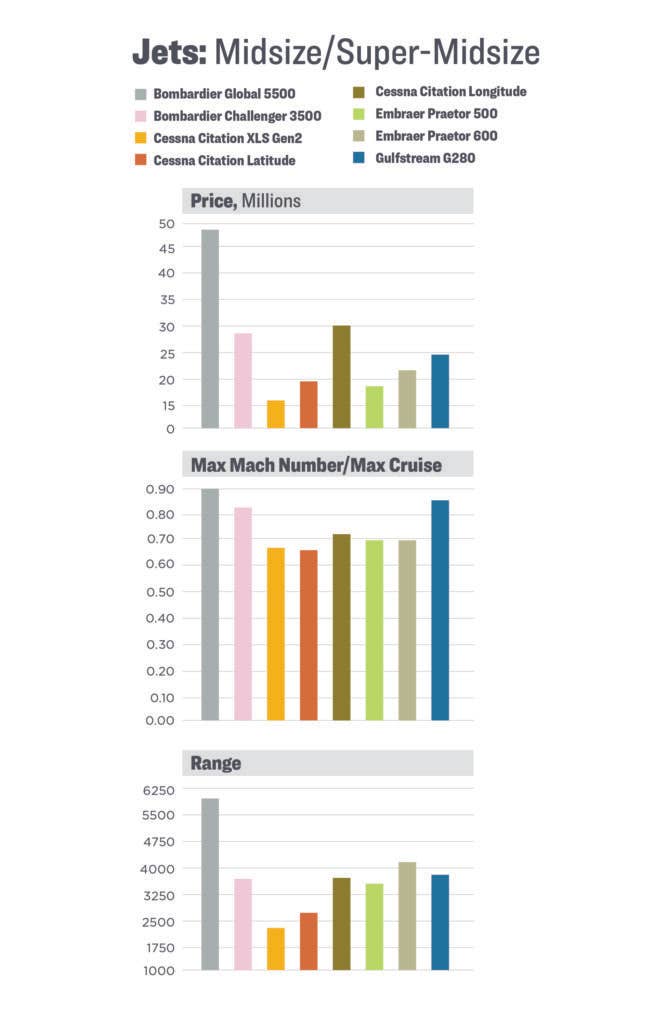

The super-midsize class remains one of the most hotly contested sectors with offerings from Bombardier, Gulfstream, and Textron, as well as Embraer. All contenders feature two cabin sections, typically configured with double-club seating or a single-club section up front and a divan plus two facing chairs at the rear. Bombardier Challenger 3500, the latest variant of the Challenger 300 that entered service in 2003, sports a cabin with nearly the same cross section as a Gulfstream V, lower cabin altitudes to reduce fatigue, more comfortable and stylish Nüage chairs and numerous connectivity and convenience upgrades.

The Challenger 300 series has been the bestseller in class for two decades because of its combination of cabin comfort, performance, operating economics, and dispatch reliability. With fat margins and fuel problems, it’s a cash cow for Bombardier. However, some industry analysts maintain Challenger 3500 is due for a major refresh to keep it competitive in the long term.

The Gulfstream G280 is the performance leader, capable of flying four passengers 3,700 nm at Mach 0.80, and eight passengers 3,500 nm at the same speed. Its cabin is slightly narrower than Challenger 3500, but it’s longer, so the volume is virtually the same. The G280 features a wing derived from the GV airfoil, albeit one with different twist and improved winglets. Fuel efficiency rivals the best class, a result of the low drag wing, fuel-efficient HTF7250G turbofans and comparatively high cruising altitudes. For example, it can climb directly to 43,000 feet on an ISA+10 degree Celsius day. Demand for G280 is getting stronger, with Gulfstream delivering 24 aircraft in 2022, according to GAMA.

Textron Aviation’s Citation Latitude is the firm’s bestselling jet, with 42 deliveries in 2022. Passengers love this airplane, especially its roomy aft lavatory. This low-risk derivative of the Model 680 Sovereign+ offers the largest cabin cross section of any Citation yet to enter production but one with impressive structural efficiency. Its increase in empty weight is less than 360 pounds compared to Sovereign+, while its cabin is 4 inches higher and 11 inches wider. It features the first flat floor in a Citation, a 9.66 psi pressurization system that maintains cabin altitude below 6,000 feet and a Garmin G5000 flight deck. Cabin width is about 5 inches narrower, and floor width is 7 inches less than in the Praetor 500, thus its cross section is the leanest in class. The Latitude’s typical block speed is 400 knots, so it’s optimized for two- to three-hour trips even though it has a 6.5-hour endurance.

- READ MORE: We Fly: Cessna Citation Latitude

The Latitude’s fraternal twin, the Citation Longitude, shares its cabin cross section, low cabin altitudes, and G5000 avionics package, but little else. The wing has a super-critical airfoil with 28.6 degrees of sweep at one-quarter chord. It’s powered by Honeywell HTF7000 series turbofans, considered best in class by Bombardier, Embraer, and Gulfstream. Normal cruises peed is Mach 0.80, so mission block times are nearly identical to those of Gulfstream G280.

The jet will fly four passengers 3,500 nm and eight passengers 3,400 nm at that speed, enabling it to cruise from New York to Paris, but not necessarily Paris to New York against winter headwinds. On typical two-to three-hour missions, the Longitude burns less fuel than the Latitude and its takeoff and landing distances are only slightly longer. Textron Aviation’s asking price is nearly $30 million, the highest in the super-midsize class, but that’s not dampening sales, again boosted by the company’s renowned product support and the air-plane’s unsurpassed low cabin noise levels. Textron Aviation delivered 26 units in 2022.

Embraer’s Praetor 600 is the value leader in this market niche. With a $21.5 million base price, it’s less than $2 million more than the Citation Latitude, yet it offers an extensive list of standard features. Along with the Praetor 500, it’s the only super-mid to have fly-by-wire flight controls. Its cabin cross is slightly smaller than either the Bombardier Challenger 3500 or Gulfstream G280 but larger than the Latitude or Longitude. Similar to the Citation Latitude and Praetor 500, there is no access to the unpressurized aft baggage compartment in flight. With a highest-in-class, 16,000-plus-pound fuel capacity, it can fly eight passengers 3,900 nm at long-range cruise. At Mach 0.80, range is close to 3,700 nm.

While orders are strong at all the jet manufacturers in FLYING’s Buyers Guide, storm clouds rapidly are forming in Europe. Climate change activists cut the airport security fence at Geneva International Airport (LSGG) in May and chained themselves to aircraft on display at the European Business Aviation Convention& Exhibition, calling for a total ban on private jets, decrying them as “toxic objects” and carrying signs that read, “Warning: Private Jets Drown Our Hope.”

Another environmental group sprayed orange paint on a Citation CJ1 at Sylt, Germany, in June, and a third splattered yellow paint over an Embraer Phenom 300E at Ibiza, Spain, in July, unfurling a banner that read, “Your Luxury = Our Climate Crisis.”

Dassault fully understands the threats posed by environmental protesters in Europe, warning that aviation bashing often translates into government regulatory policies. Amsterdam’s Schiphol Airport (EHAM), for instance, plans to ban private jets after 2025. Dassault officials counter that all 2,100 Falcon Jets in service produce the same emissions as a single day of internet video streaming.

To put business jet aviation emissions into perspective, it’s constructive to first look at global energy-related carbon dioxide emissions. In 2022, the total was 36.8 billion metric tons, according to the International Energy Agency. IAE says aviation represents 2 percent of total CO2 emissions, or 736 million metric tons. ICAO also quotes a 2 percent aviation share, based upon research conducted by the Intergovernmental Panel on Climate Change. GAMA claims that business aviation represents 2 percent of all aircraft emissions, or 14.7 million metric tons.

The World Health Organization, in contrast, reports the tobacco industry emits 84 million metric tons of CO2 every year, more than 5.7 times as much as business aviation. FLYING knows of no climate change activists who are protesting cigarette smoking.

“There’s [an] angle of class warfare here,” says Epstein, the Bank of America analyst.

Says another business aviation veteran: “Business jet owners are targeted as fat cats that don’t have to go through TSA. It’s not yet an existential threat in the U.S. But what happens in Europe eventually comes here.”

In light of growing public sentiment regarding the carbon impact of private jets, the business aviation industry has committed to slashing total CO2 emissions by 50 percent by 2050 compared to 2005. Transitioning from fossil fuel to sustainable aviation fuel (SAF or bio jet-A) can reduce overall aircraft CO2 emissions by 80 percent, according to the International Air Transport Association. Some SAF advocates claim up to 90 percent reduction, depending upon the bio feedstocks and production processes.

The challenges to making the jump from fossil jet-A to SAF are immense. Currently, the aviation industry uses close to 100 billion gallons of jet-A annually but only 14 million gallons is SAF, the majority of which was purchased by business jet operators, according to Timothy Obitts, CEO of Alder Fuels, a leading sustainable fuels company in Virginia. One big hurdle to scaling up SAF production is price. The wholesale cost of biojet is up to three times as much as fossil fuel, so FBOs are bound to charge a substantial premium for it, squeezing the already tight budgets of many light jet operators.

“Scaling up production of SAF is beyond the scope of business aviation,” says Epstein. “It’s not happening anytime soon. It’s going to take a massive investment by government. And then business aviation can ride on the coattails.”

However, the underpinnings of the business jet sector remain strong.

“People want to travel by air,” Epstein says. “The industry needs to be aware of climate change pressures and manage them. Climate change activists aren’t the ones buying business jets.”

| Aircraft Make/Model | Manufacturer Base Price | Engine | Seats | Maximum Takeoff Weight | Full Fuel Payload |

| Bombardier Challenger 3500 | $27.2 million | 2 x Honeywell HTF7350 | up to 10 | 40,600 lb. | 1,800 lb. |

| Bombardier Challenger 650 | $33 million | 2 x General Electric CF34-3B MTO | up to 12 | 48,200 lb. | 1,150 lb. |

| Bombardier Global 5500 | $47.4 million | 2 x Rolls-Royce Pearl 15 | up to 16 | 92,500 lb. | 2,639 lb. |

| Bombardier Global 6500 | $58 million | 2 x Rolls-Royce Pearl 15 | up to 17 | 99,500 lb. | 2,470 lb. |

| Bombardier Global 7500 | $81 million | 2 x General Electric Passport | up to 19 | 114,850 lb. | 1,890 lb. |

| Cessna Citation M2 Gen2 | $6.15 million* | 2 x Williams FJ44-1AP-21 | 7 | 10,700 lb. | 3,810 lb. useful load |

| Cessna Citation CJ4 Gen2 | $11.86 million* | 2 x Williams FJ44-4A | 10 | 17,110 lb. | 6,950 lb. useful load |

| Cessna Citation Latitude | $19.78 million* | 2 x Pratt & Whitney PW306D | 19 | 30,800 lb. | 12,394 lb. useful load |

| Cessna Citation Longitude | $29.99 million* | 2 x Honeywell HTF7700L | 12 | 39,500 lb. | 16,100 lb. useful load |

| Cirrus Vision Jet G2+ | $3.29 million* | 1 x Williams FJ33-5A | 7 | 6,000 lb. | 1,400 lb. max payload |

| Dassault Falcon 7X | $54.2 million | 3 x Pratt & Whitney PW307A | 12-14 | 70,000 lb. | 3,988 lb. |

| Dassault Falcon 8X | $63.8 million | 3 x Pratt & Whitney PW307D | 12-14 | 73,000 lb. | 1,959 lb. max payload |

| Dassault Falcon 2000LXS | $44.7 million* | 2 x P&W PW308C | 8-10 | 42,800 lb. | 2,755 lb. |

| Dassault Falcon 900LX | $36 million | 3 x Honeywell TFE731-60 | 12-14 | 49,000 lb. | 2,480 lb. |

| Embraer Phenom 100EV | $4.495 million | 2 x Pratt & Whitney PW617F1-E | 6 or 8 | 10,703 lb. | 647 lb. max payload |

| Embraer Phenom 300E | $10.295 million | 2 x Pratt & Whitney PW535E1 | 8 or 11 | 18,552 lb. | 1,586 lb. max payload |

| Embraer Praetor 500 | $17.995 million | 2 x Honeywell HTF7500E | 2+9 | 37,567 lb. | 1,610 lb. max payload |

| Embraer Praetor 600 | $21.495 million | 2 x Honeywell HTF7500E | 2+12 | 42,858 lb. | 2,194 lb. max payload |

| Gulfstream G280 | $24.5 million* | 2 x Honeywell HTF7250G | 8-10+2 | 39,600 lb. | 4,050 lb. max payload |

| Gulfstream G500 | $49.5 million* | 2 x Pratt & Whitney PW814GA | up to 19 | 79,600 lb. | 5,250 lb. max payload |

| Gulfstream G600 | $59.5 million* | 2 x Pratt & Whitney PW815GA | up to 19 | 94,600 lb. | 6,540 lb. max payload |

| Gulfstream G650ER | $70.5 million* | 2 x Rolls-Royce BR725 | up to 19 | 103,600 lb. | 6,500 lb. max payload |

| HondaJet Elite II | $6.95 million* | 2 x GE Honda HF120 | 1+7 | 11,100 lb. | 3,974 lb. useful load |

| Pilatus PC-24 | $12.2 million** | 2 x Williams FJ44-4A | 1+11 | 18,300 lb. | 715 lb. |

| Aircraft Make/Model | Fuel Burn | Max Speed | NBAA IFR Range | Stall/VREF Speed | Takeoff Field Length | Landing Distance |

| Bombardier Challenger 3500 | NA | 0.83 Mach | 3,400 nm | NA | 4,835 ft. | 2,308 ft. |

| Bombardier Challenger 650 | NA | 0.85 Mach | 4,000 nm | NA | 5,640 ft. | 2,402 ft. |

| Bombardier Global 5500 | NA | 0.90 Mach | 5,900 nm | NA | 5,340 ft. | 2,207 ft. |

| Bombardier Global 6500 | NA | 0.90 Mach | 6,600 nm | NA | 6,145 ft. | 2,236 ft. |

| Bombardier Global 7500 | NA | 0.925 Mach | 7,700 nm | NA | 5,760 ft. | 2,237 ft. |

| Cessna Citation M2 Gen2 | 830 pph | 404 ktas | 1,550 nm | 83 kias | 3,210 ft. | 2,590 ft. |

| Cessna Citation CJ4 Gen2 | 1,299 pph | 451 ktas | 2,165 nm | 86 kias | 3,410 ft. | 2,940 ft. |

| Cessna Citation Latitude | 1,770 pph | 446 ktas | 2,700 nm | NA | 3,580 ft. | 2,480 ft. |

| Cessna Citation Longitude | 1,810 pph | 483 ktas | 3,500 nm | NA | 4,810 ft. | 3,170 ft. |

| Cirrus Vision Jet G2+ | 442 pph | 311 ktas | 1,275 nm | 60 kcas | 2,036 ft. | 1,628 ft. ground roll |

| Dassault Falcon 7X | 2,210 pph | 0.90 Mach | 5,950 nm | 104 kias (VREF) | 5,710 ft. balanced field | 2,070 ft. |

| Dassault Falcon 8X | 2,240 pph | 0.90 Mach | 6,450 nm | 107 kias (VREF) | 5,880 ft. balanced field | 2,220 ft. over 50-ft. obs |

| Dassault Falcon 2000LXS | 1,480 pph | 0.86 Mach | 4,000 nm | 105 kias (VREF) | 4,675 ft. | 2,260 ft. |

| Dassault Falcon 900LX | 1,620 pph | 0.87 Mach | 4,750 nm | 110 kias (VREF) | 5,360 ft. | 2,415 ft. |

| Embraer Phenom 100EV | 88 gph | 406 ktas | 1,178 nm | 95 ktas | 3,190 ft. | 2,473 ft. |

| Embraer Phenom 300E | 124 gph | 464 ktas | 2,010 nm | 103 ktas | 3,209 ft. | 2,212 ft. |

| Embraer Praetor 500 | 214 gph | 466 ktas | 3,340 nm | 101 ktas | 4,222 ft. | 2,086 ft. |

| Embraer Praetor 600 | 236 gph | 466 ktas | 4,018 nm | 104 ktas | 4,717 ft. | 2,165 ft. |

| Gulfstream G280 | NA | 0.85 Mach | 3,600 nm | 115 kias (VREF) | 4,750 ft. | 2,365 ft. std config |

| Gulfstream G500 | NA | 0.925 Mach | 5,300 nm | 117 kias (VREF) | 5,300 ft. | 2,645 ft. std config |

| Gulfstream G600 | NA | 0.925 Mach | 6,600 nm | 109 kias (VREF) | 5,700 ft. | 2,365 ft. std config |

| Gulfstream G650ER | NA | 0.925 Mach | 7,500 nm | 115 kias (VREF) | 6,299 ft. | 2,445 ft. std config |

| HondaJet Elite II | 638 pph/392 ktas/FL430 | 422 ktas | 1,547 nm | 108 ktas | 3,699 ft. MTOW | 2,717 ft. 4 pax/NBAA |

| Pilatus PC-24 | 159 gph | 438 ktas | 2,129 nm | 82 kias | 2,930 ft. over 50-ft. obs | 2,120 ft. over 50-ft. obs |

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox