Southwest Airlines Fuel Bet Will Pay Off

The hedge will save the airline $1.2 billion this year.

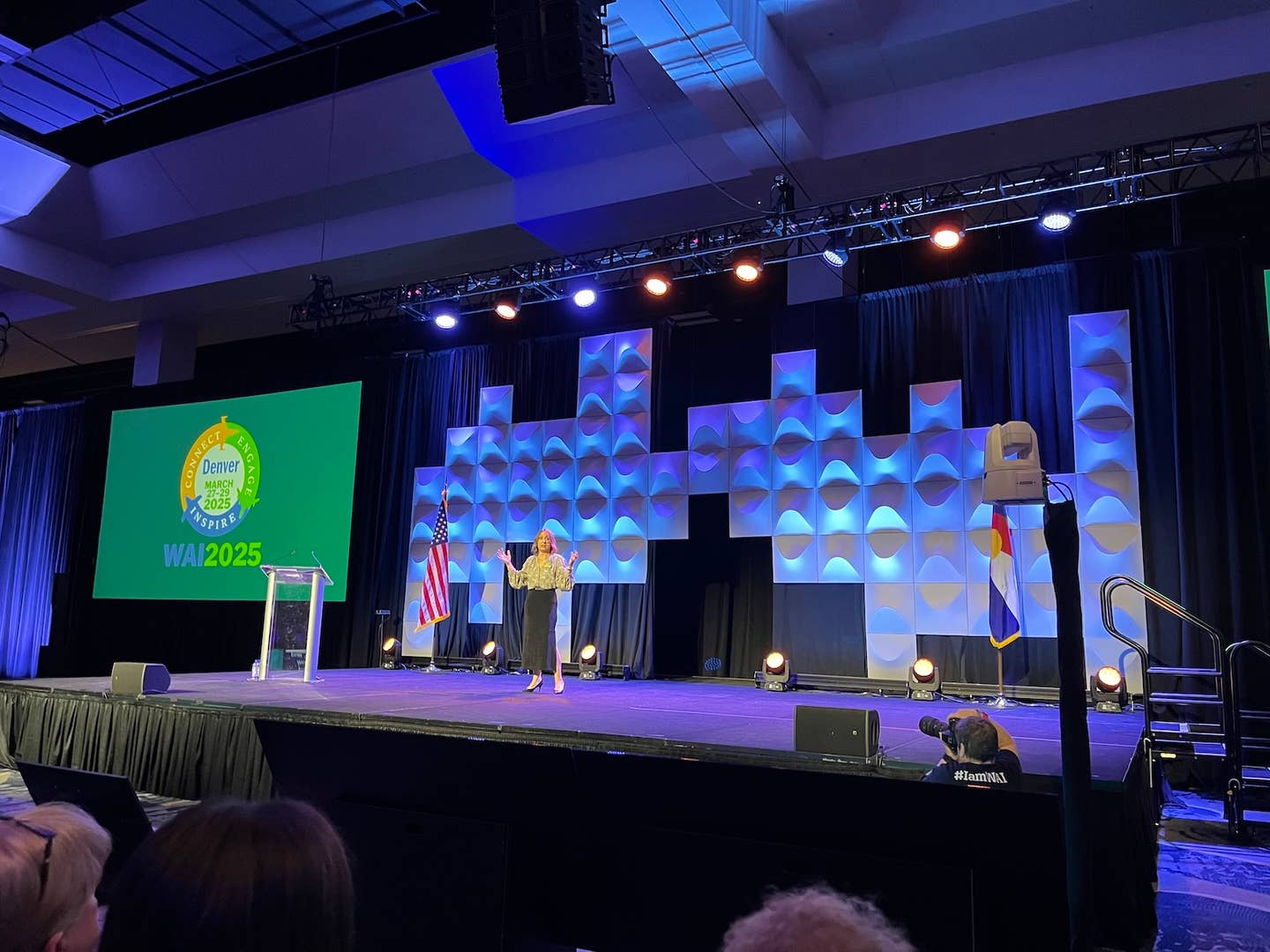

Southwest CFO Tammy Romo told investors that the company’s “fuel hedge provided excellent protection against rising energy prices.” [Photo: Thom Patterson]

Southwest Airlines (NYSE: LUV) managed to save $1.2 billion this year after making some savvy deals on its fuel contracts. In a recent SEC filing, the company said its multi-year fuel hedging program provided coverage against spikes in jet fuel prices.

The loss of Russia from the oil supply chain has caused oil prices and jet fuel to skyrocket, forcing airlines to fork over more money to cover their trips or trim their schedules. Plus, with the relaxing of COVID border restrictions, demand for fuel has only gone up, with little extra to go around. The Energy Information Administration (EIA), which tracks fuel prices, said a year ago while the world was still in the throes of the pandemic, jet fuel cost four times less than it does now—on average, it was $1.90 per gallon during the same week in June 2021. Last Monday, June 27, this year, that price was $4.13 per gallon.

Southwest Hedged, Other Majors Didn’t

Southwest CEO Bob Jordan told investors at the end of the first quarter of 2022 that the company expected a "meaningful fuel hedge gain in the second quarter, and remains well protected with our fuel hedge portfolio in the second half of this year."

Meanwhile, the other three majors, American [NASDAQ: AAL], Delta [NYSE: DAL], and United [NASDAQ: UAL], on their respective earnings calls at the time, said they would not hedge and would pay the price at the pump. Ultimately, those bets have proven costly as their fuel estimates—though similar to what Southwest hedged at—were much less than what fuel ended up costing, as the EIA data shows.

The non-hedging carriers have been passing those expenses on to customers, who haven’t blinked at the higher ticket prices, owing to pent-up travel demand resulting from the pandemic. In the filing, Southwest said it expected its load factor for the second quarter to still only reach 87 percent of peak pre-pandemic travel compared to 2019, but that revenue during the same time would be 15 percent more.

With the fuel hedging program, the airline said that as of June 16, "the fair market value of the company's fuel derivative contracts settling in the remainder of 2022 was an asset of approximately $758 million,” which would bring full year savings to approximately $1.2 billion. For 2023 and 2024, the company said the market value of those fuel derivative contracts would be worth roughly $615 million and about $161 million, respectively.

Airlines typically spend a third of their operating expenses on fuel, so even when they can reduce the margin to cents, it can result in considerable savings. For Southwest, the airline said it saved $0.70 per gallon for the second quarter, between $3.30 to $3.40 per gallon, and that was enough for the windfall it stands to rake in. Even more, going into the second quarter, the company said it would only hedge 63 percent of its fuel for the second quarter, which means the upside could've been much more.

Fuel derivatives are a type of financial instrument, like stocks and bonds, that companies can trade based on the cost of the expected underlying price of oil. When companies hedge, they lock in specific prices so that if the market price fluctuates following uncertainties, they only have to pay the agreed price. It serves well when the price goes up but becomes a premium if the price goes down.

Solid Profits Ahead

From the company's first quarter earnings call, Southwest CFO Tammy Romo told investors that the company's "fuel hedge provided excellent protection against rising energy prices" and would serve as a "meaningful cost mitigation" for the year.

For Southwest, with the uptick in travel and savings in fuel, the company said in its SEC filings that "barring any unforeseen events and based on current trends," it expected "solid profits" for the second through the fourth quarter and the entirety of 2022. Boasting its financial prowess, the company said it remained the only U.S. airline maintaining an "investment-grade rating by all three rating agencies."

Pilot Contract Still in Question

The company is expected to report the results from its third quarter at the end of July. Aside from fuel, investors will want to know the company's progress in negotiating with its pilots for a new contract. Last week, more than 1,300 off-duty but uniformed Southwest Airlines pilots lined up along the sidewalks of the Dallas Love Field Airport (KDAL) to demand a new contract.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox