Student Loans Aren’t the Only Way to Fund Your Training

There are other ways to fund the pursuit.

If traditional numbers don’t add up, you might have to use some different methods to get yourself trained. [File photo: Adobe Stock]

Two of the dominant responses to our recent pilot shortage series surrounded the affordability of training and pilot pay entering the workforce. Many experts suggested that the numbers were just off.

For many who decide to go on this worthwhile pursuit of becoming a professional pilot, student loans offer an opportunity to pursue their dreams. Indeed, they seem quite generous. Between private and federal lenders, new students can get almost unfettered access to cash.

But should you fund your training only through student loans? Students attending colleges/universities enjoy the benefit of applying for federal and state financial aid grants (including federally backed student loans) for paying for tuition, books, and other fees. Elsewhere, pilots have options to complete all their flight training with companies that can take you from zero to hero in less than nine to 12 months that covers costs using a personal loan that starts accruing interest (often at significant rates unless collateralized by a home or other assets) with payment schedules that begin the moment the money is accepted.

The Back-Up Plan

There are two experiences that have shaped my decision-making psyche in my relatively young pilot career.

The first came at the very start. In the first semester of my freshman year of college, before I even set foot in an airplane, I tore my ACL trying to earn a soccer scholarship. While inconvenient, my injury wouldn’t have been as disruptive in some other careers, but pilots need their legs to push rudder pedals. So a torn ACL stood in my way—both for soccer and aviation.

“While incoming pilots are promised a lucrative career, I wonder if there is another way to unburden students for the future?”

I set my soccer pursuits aside and had to rehab for the entire school year, missing a complete academic cycle in flight training. At the very beginning, I realized how tantamount my health would be to my career. Plus, aside from the disruption, the whole thing made me question putting all my eggs in one basket.

When I wrote about whether pilots should go to college, many people emailed me that a pilot degree offered many people something to fall back on if things went wrong. They were onto something, but I wonder what would happen if this could be the way experts advised those going into flight training. In other words, would it be better to counsel student pilots that, in addition to flight training, they should consider the broad trends of where the world is going and select a comparable field of study that they would enjoy equally, expecting that something could go wrong?

For one, it would let them know that other options are on the table—that if you have the mindset to be a pilot, there are equally rewarding fields worth pursuing. It doesn’t have to be something to fall back on.

Save Money. No, Really

The other experience that shaped my career was the matter of paying for training each time I flew. Because I moved to the U.S. for flight training as an international student, I was only able to attend college because my parents could afford to send me there. I wouldn’t be privy to the riches of private and federal student loans some of my classmates benefited from.

In one way, my ACL injury bought us time to figure out consistent cash flow, because as most pilots will explain, the most efficient way through training is to move through it without stopping. If you have to pause, as many do, for financial reasons, later on, it may affect your proficiency. That’ll mean spending more on sessions to get refreshed.

The other upside is that when I paid for each training session, I fully understood the reality of spending hard-earned cash, and it encouraged me to develop habits that ensured my time in training was efficient. Money means something when you know where it came from. Accepting that loans weren’t an option forced my parents and me to think about additional ways to generate income, and after I completed my training, those streams of revenue remained. What would happen if you didn’t jump right into training but considered that, too?

When I finally graduated college, I realized that these two consequences may have had the most enduring positive effects on my career. Understanding the volatility of my career and being debt-free is a long runway to almost anywhere.

Later on, when I began working as CFI, I found myself in another quandary. My paycheck would fluctuate based on things beyond my control, such as weather, mechanical delays, ATC delays, and others. Being pushed to my own financial limits with very little wiggle room, I wondered how my counterparts handled all this with their student loans.

How Pilots Typically Approach Loans

On different occasions, I encountered pilots with fully financed loans of more than $200,000. They explained that they’d have 20 years to pay it off, and their monthly payments varied between $1,000 to $2,000. There was no room for disruption. Sure, some would be able to refinance these loans as they went along, moving on to airlines and climbing the seniority ladder, but when we zoom out, working nearly two decades to become whole again financially seems expensive. I say expensive because conventional wisdom holds that time, over money, is the most important commodity.

According to Data USA, a database by Deloitte and MIT that tracks public U.S. data, the average age of major airline pilots is 44.4 years. Elsewhere, the U.S. Department of Labor, Bureau of Labor Statistics (BLS) also shows that the median pay will work out to be $160,970. Another way to look at this is that even with the industry’s pilot shortages—and the current financial incentives offered by many airlines—it takes years to get to the point where you get to start reaping the rewards of the investment made in training. In fact, a common sentiment among pilots has been to embrace sticking to a tight budget while repaying their loans in the early parts of their earning career, and to be as close-fisted as possible in the early years, as there are rewards on the backend.

After all, the cash flow at the early part of their careers—and their existing loans—demand it.

Is there another way?

While incoming pilots are promised a lucrative career, I wonder if there is another way to unburden students for the future? Furthermore, when we look at the scale and pace of the projected return-on-investment for those who study in fields such as software or computer engineering—especially with low barriers to entry—could pilots set themselves up better by pursuing a degree in these fields? And have a more enjoyable lifestyle upfront and still relish the benefits of flight by being able to actually afford it?

Embrace emerging technologies for their financial upside.

There are many options here that I think students should consider. For one, as I have argued before, pay attention to the trends in the industry. When I wrote about the threat and promise of advanced air mobility, apart from the disruption that is predicted to come to the industry, there’s actually an opportunity to pair your desire for flight with a burgeoning field of students. This might not please many departments with dedicated pilot programs, but at the end of the day, your future is ultimately in your hands.

If you are to go into debt with student loans, would it be more worthwhile to consider the emerging technologies across the entire aviation industry that might require someone who is not only a pilot, but also has the technical capabilities to work on those projects, and furthermore, are offering a lot more capital upfront? You could have the best of both worlds.

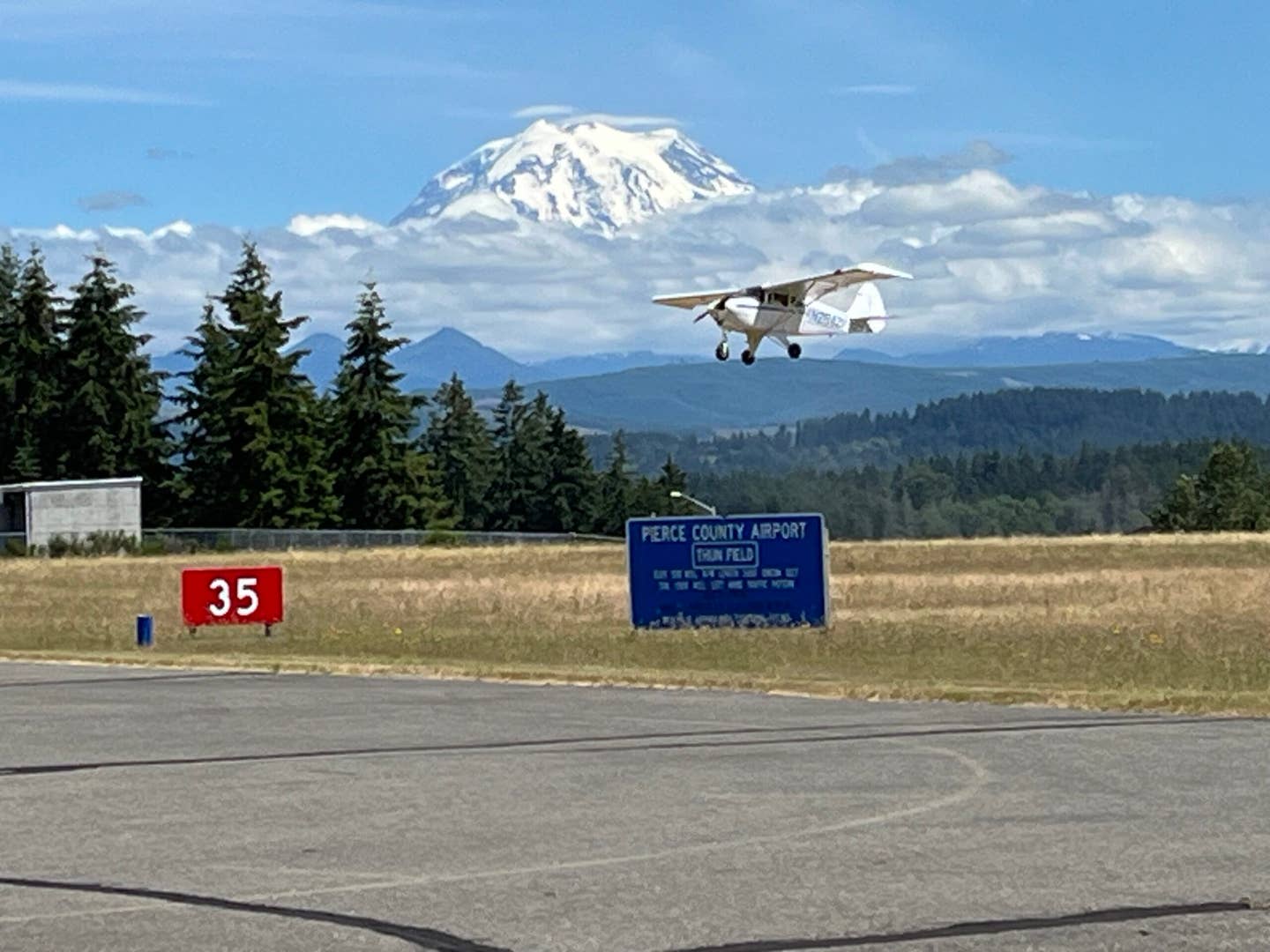

Should you buy your own airplane for training?

There’s one other thing you might consider. Buy your own airplane for training. Believe it or not, the college professor who taught the ground portion of my CFI course advised us to do so, though we laughed at the idea. In hindsight, Professor Joe Clark was on to something. With the removal of the complex requirement making it possible to do most of your training in one aircraft, a used Cessna 172 could get students through all their training, from private to CFI, and they would only have to rent for their multiengine ratings. If they did it with a partner, it could come at a fraction of the cost of the traditional way but would have positive long-term effects as you’d be able to acquire hours for your airline transport pilot certificate much faster and sell the airplane afterward to recapture the money invested. The plan offers the additional upside of aircraft ownership—convenience, and pride.

There is more to be said about pilots and student loans. In March 2020, when the industry was handbraked because of the pandemic, an interesting phenomenon took place. The airline industry, like most others, is predicated on pilot workforce flow, backstopped by mandatory retirement at 65 years old for senior pilots. This allows newcomers to come in and realize their initial investment in training. Yet, even though everything paused suddenly, it took a while for the flow of pilots already in motion to come to a halt—who’d already borne the costs of training and were either now facing furloughs or a pause in pilot hiring even with their student loans still due. What would’ve happened to the industry if the government didn’t provide relief? If pilots couldn’t continue to move up the pay scale—because there were no upgrades, or that departments simply weren’t hiring—how would they be able to handle their real cost?

How then should you think about financing your professional pilot career? As I’ve shared, my experiences allowed me to see that there were more options than I initially imaginedIf you are to take out student loans to finance a college degree, I think it is worthwhile to consider degree programs that aren’t specifically tailored to pilots. Instead, look at those with lower barriers, such as just needing internet access or access to some software, but which offer more immediate upsides right out of college. You can pursue your flight training at the same time and enjoy the benefit of both without having all your “financial eggs” in one basket. Additionally, it is worth considering subsidizing the cost of training by purchasing a trainer aircraft that will serve you long after training.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox