Virgin Galactic posted a loss of $48.8 million in the third quarter of 2021. Virgin Galactic

Virgin Galactic Holdings (NYSE: SPCE) has notched another quarterly loss amid delays in its commercial space service as it shifts its focus to making enhancements to aircraft.

The aerospace and space travel company, announcing its third quarter results on Monday, posted a loss of $48.8 million, improving from a $92.1 million loss a year earlier.

After hours and at the time of reporting, its stock price was slightly down, trading at $19.63, off the $19.89 at the close.

Assessing the Demand

But despite the third quarter setback, the news was not all bad.

During a Q&A segment Monday evening, company officials said it has targeted 1,000 people whom they have labeled as space-faring, and so far have sold more than 700 of the 1,000 seats, 100 of which cost $450,000 each. Moreover, following the Unity22 flight, it was able to garner interest from another 60,000 would-be space tourists, which the company says it’s now sorting through to determine actual interests and capabilities. Officers said on the call that they one day hope to offer up to 400 flights per year.

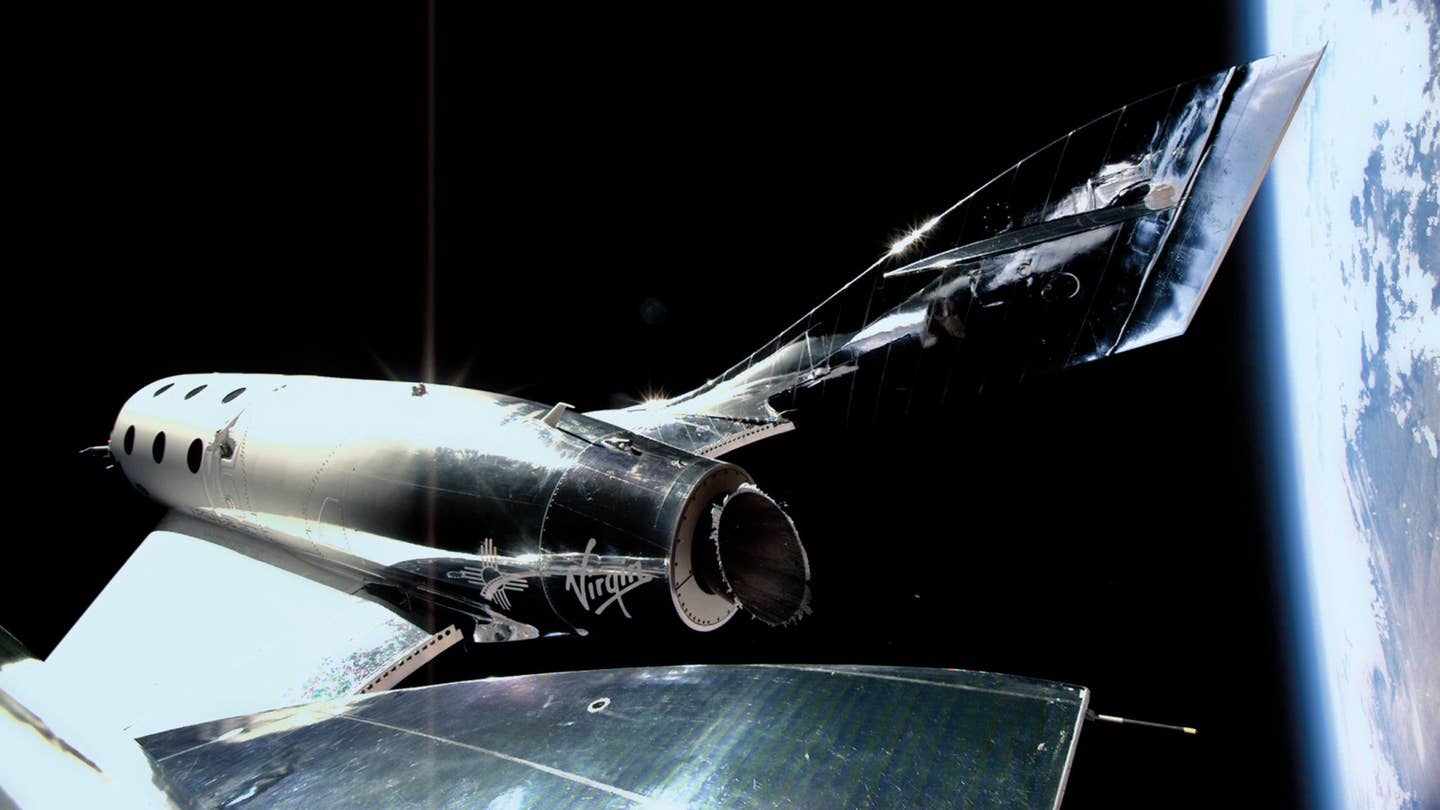

On July 11, 2021, Virgin Galactic successfully completed its first fully crewed spaceflight, Unity22, when its billionaire owner Richard Branson became the first person to ride to space on a rocket he helped to fund. The flight served to also evaluate the cabin and customer experience, which the company was adamant was the distinguished quality among competitors. Branson’s flight kicked off an expanding space tourism business, as days after, another billionaire, Jeff Bezos, also flew to the edge of space, reaching a higher altitude in his Blue Origin rocket.

Last month, the company said it would push offerings of its commercial flights until the fourth quarter of 2022. As the company focuses its near-term energy on enhancements and refurbishing of its fleet, general and administrative expenses jumped 61 percent to $50 million.

The company initially planned to offer tourism services this quarter but decided to delay it to improve its infrastructure to allow it to increase the number of flights, decrease downtime due to scheduled maintenance events, and increase the service life of its vehicles.

It also plans to expand its fleet through its Design and Collaboration Center, Delta Class Spaceship Program, and a Next Generation Mothership Program.

After not reporting a revenue last year, the company reported $2.6 million in revenue this quarter, citing the increase in enhancements and refurbishments as the driving factor.

Fleet Enhancements and Refurbishments

“We are entering our fleet enhancement period with a clear roadmap for increasing the durability, reliability and predictability of our vehicles in preparation for commercial service next year,” said Michael Colglazier, chief executive officer of Virgin Galactic.

According to its website, the Unity 23 test flight—a project with the Italian Air Force that was originally targeted for late October—will fly after the enhancement program is completed next year.

Refurbishments have directed analyst to focus on the company’s cash burn, and despite the dilution round after Richard Branson’s flight to the edge of space during the summer, but analysts question the actual direction the company seems to be heading, speculating that the company might pivot to hypersonic flight in its space plane.

FAA Investigation

Virgin Galactic CEO Michael Colglazier also addressed the FAA investigation that briefly grounded the company when the crew piloting the spacecraft allowed the aircraft to deviate from its restricted airspace during the mission on July 11.

In a statement at the time, the FAA said, “The investigation found the Virgin Galactic SpaceShipTwo vehicle deviated from its assigned airspace on its descent from space” and that “Virgin Galactic failed to communicate the deviation.”

Colglazier said much of the “significant media coverage” that the deviation garnered was “misconstrued,” but that the company took steps to improve its operations going forward.

Following the inquiry, the company was required to update its communication capabilities and calculations to “to expand the protected airspace” during future missions, as well as take “additional steps” to ensure the FAA receives “real-time mission notifications.”

Going Forward

Sentiments around the stock are mixed, as the compounding delays, competition, and slower than expected ticket sales are causing analysts to question the timeline of the companies projection to make space tourism actually attainable, or with them suggesting they might only become cash-flow positive at the time of the delta program.

Correction: This story has been updated to reflect that 100, not 700, seats have been sold for an updated price of $450,000 each.

Sign-up for newsletters & special offers!

Get the latest FLYING stories & special offers delivered directly to your inbox

![United Airlines secures FAA approval for Starlink, with first commercial flights set for May. Starlink offers 50x faster internet, free for MileagePlus members. [Courtesy of United Airlines]](https://www.flyingmag.com/uploads/2025/03/UnitedAirlines_Starlink_Image.jpg?auto=webp&auto=webp&optimize=high&quality=70&width=1440)